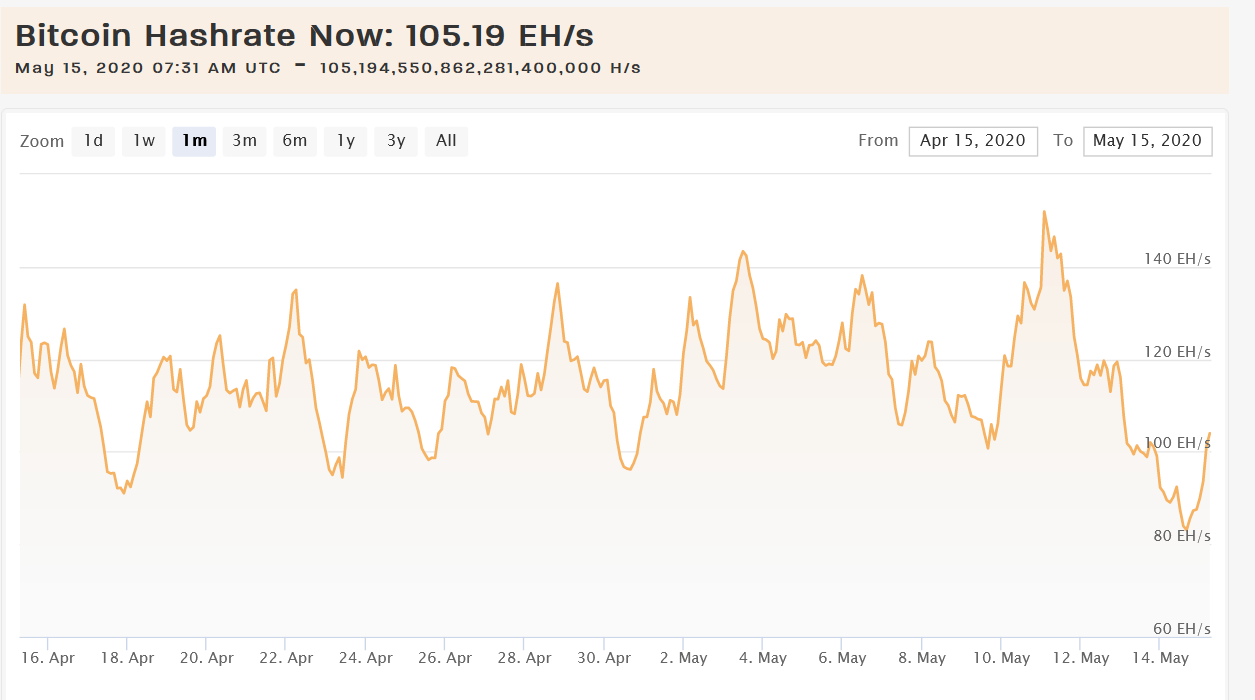

After the endless hype around the halving, now Post halving BTC hash rate dropped by 36 percent as miners decided to flee. What does this mean for the Bitcoin price? Let’s find out in the latest Bitcoin news.

The crypto analyst and founder of Quantum Economics, Mati Greenspan explained that the post halving BTC hash rate dropped by 36 percent but he stated that this is what he expected. We can see a recovery from the halving today as the hash rate is at 105 EH/s, bouncing from the recent lows of 83 EH/s. The last time that the hash rate was at this point, was two months ago when Bitcoin’s price dropped to $3.9 thanks to the panic induced on Wall Street.

#bitcoin hashrate has dropped 36% since the #halvening.

Still well within the long term range. So far this is just a reversion to the mean. pic.twitter.com/A2BWmp5o8d

— Mati Greenspan (tweets are not trading advice) (@MatiGreenspan) May 14, 2020

After the halving, the erosion of the block reward means that the revenue of the miners was drastically cut. The squeeze on the Bitcoin mining model drives the miners that are not efficient out of business as the chart shows. The miners’ revenue dropped to $7.8 billion after the halving. The biggest expense by far for Bitcoin is the cost of electricity which can vary depending on the location. The inefficiencies apply to the use of the older mining rigs which cannot compete with the equipment of today.

The cost of competing to solve the math puzzle is not worth for the operating old equipment or for anyone with the above-industry electricity costs. The net results are eventually the same: miners will leave. As it was explained by the crypto exchange OKEx in their latest blog post ‘’The dynamics of bitcoin hash rate and price’’ we can read that:

“When BTC price increases, the hash rate increases; when BTC price decreases, the hash rate also decreases.”

Still, while the hash rate sees some major pullbacks from the miners that are leaving the network, the price has not followed suit yet. The price of Bitcoin reached another high of under $10K which is a 15 percent gain after the halving event and the expectations. Some of the analysts say that the concentration of miners is good for the price since they can afford to hold Bitcoin and flood the market. others are still mindful about the anomaly between the hash rate and the price and with the predictions, extreme caution is required over the upcoming weeks.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post