Some analysts are worried because of the fact that open interest on Bitcoin options contracts is expiring next Friday and amounts to $930 million now. This leads many to ask what price action should be expected from the coin and what are we going to see in the Bitcoin news next.

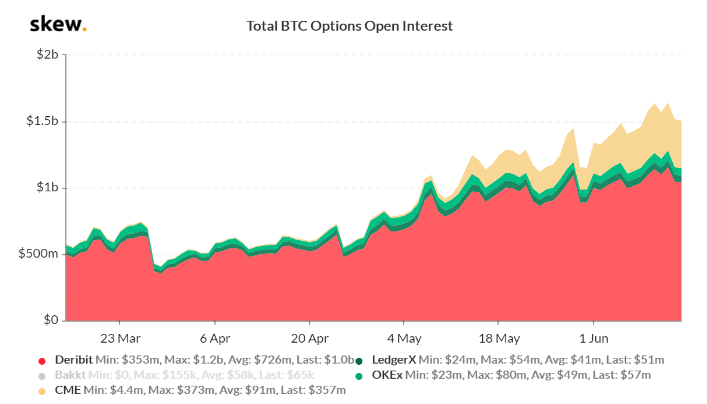

Basically, the past period we saw that much attention has been paid to the Bitcoin options and futures market. Each week, crypto media reports on new record open interest figures being achieved.

As the date of another futures and options approaches, traders are becoming anxious due to the fact that the Bitcoin (BTC) price has consistently failed to cross the $10,000 mark. Now, there is some pressure in the cryptocurrency news as open interest on $930 million worth of Bitcoin options contracts is expiring next Friday.

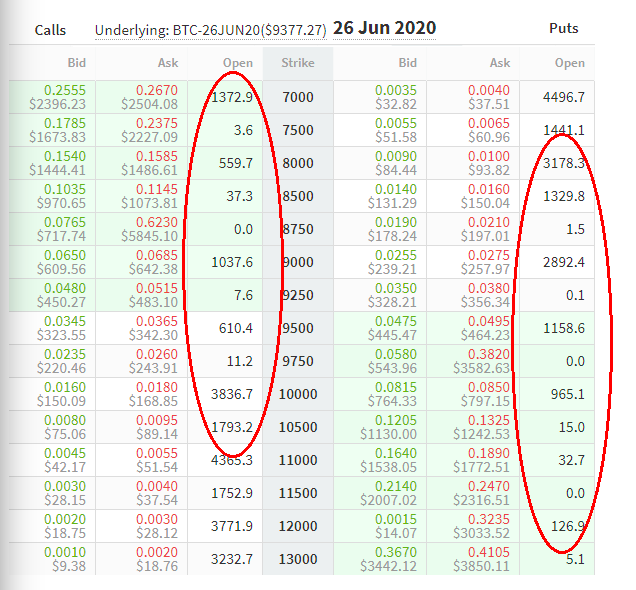

More than 100,000 Bitcoin options totalling $930 million are set to expire on June 26, a figure that represents nearly 70% of the entire open interest. On June 15, the Bitcoin price pulled back to $8,900 and led investors to question whether traders have turned bearish as the June 26 expiry date approaches.

Even though the open interest is not something that predicts market trends, it is possible to gain new insights by analyzing additional data such as put/call ratios. This is an indicator that provides a clear picture of the investor sentiment as call options are commonly used for bullish strategies.

The data from Skew shows that open interest reached $1.3 billion which saw an increase of 100% in the past two months. However, the June 26 expiry for the current CME contract consists almost entirely of call options which are known as bullish positions. Because of that, 75% of such open interest now sits at the unlikely scenario of $11,000 and higher-level expiries.

As you can see on the image above, Deribit holds 50% of the 100,000 Bitcoin options with an expiry date on June 26. Unlike CME, the exchange offers contracts starting from 0.10 BTC. Institutional investors can also access the over-the-counter (OTC) block trading solutions.

Generally speaking, the futures markets sentiment is slightly bullish, but should be taken with reserve as the open interest for Bitcoin options contracts is expiring.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post