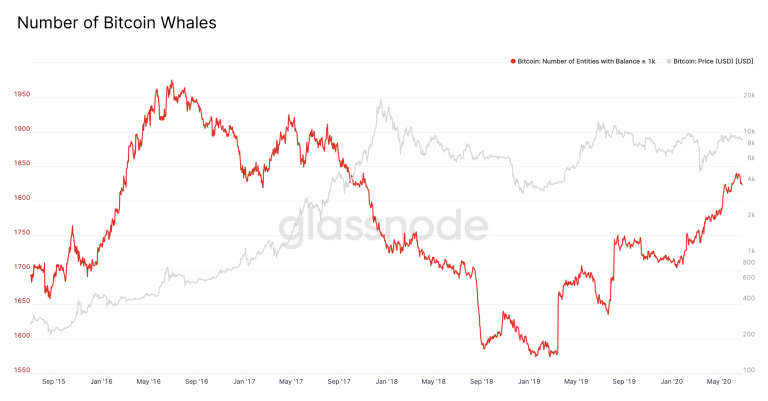

The number of Bitcoin whales in the cryptocurrency news has been rising since the start of 2019 and all of this pointed to an intense accumulation phase among the large investors who now hold massive amounts of crypto.

As we can see from data, the growth of this number indicates that investors with access to large sums of capital do believe that the long-term outlook of the coin is bright, as it is fast approaching its all-time highs which were set in May 2018.

buy lasix online www.parkviewortho.com/wp-content/languages/new/prescription/lasix.html no prescription

Data shows that the number of Bitcoin whales is not growing because of new money entering the market – but instead, due to these entities withdrawing their BTC from exchanges. Currently, Bitcoin whales control 22% of the circulating supply of cryptocurrency all over the Web.

The number of crypto whales – defined as entities that are holding more than 1,000 BTC – has been growing lately and shows that the mid-term outlook of the market remains bright. Data from the crypto analytics platform Glassnode confirmed this and the chart below shows that the accumulation pattern first began in January 2018 after it slid lower over a multi-year period.

“When we zoom out to view bitcoin’s full history, we see that the BTC balance held by whales peaked in early 2016, and then started decreasing consistently. Despite the increase in whale holdings this year, the balance of BTC held by whales is still well below the peak,” Glassnode explained.

Currently, the number of Bitcoin whales is growing and if you are wondering why this is the case, Glassnode explains that it does not mark an influx of fresh capital on the market. Instead, these whales are moving their crypto holdings away from exchange wallets and into cold storage.

“Much of the recent increase in the number of whales can be explained not by new money, but rather by existing wealthy entities withdrawing their BTC from exchanges.”

As we previously reported in our Bitcoin news, crypto exchange outflows from whales are often preceding bull markets. This report shared on our site quoted the CEO of CryptoQuant, Ki Young Ju, who said that the cryptocurrency bull markets tend to start approximately four months after whale outflows from exchanges hit their respective yearly highs.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post