The non-zero BTC addresses reach an all-time as they started increasing again just recently so let’s read further in our latest Bitcoin news today.

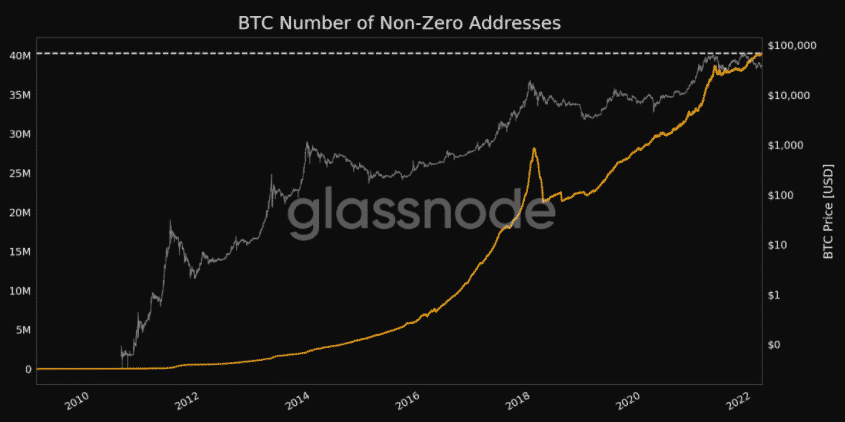

The on-chain metrics about BTC reversed after the recent bearish signals with the number of non-zero BTC addresses holding at least one whole BTC hits new peaks. This comes shortly after the whales and other entities made transfers of their BTC holding amid the ongoing war between Russia and Ukraine. As the name suggests, the non-zero addresses are wallets that contain a small fraction of BTC and a chart by Galssnode even shows that such entities started increasign lately and charted new highs surpassing 40 million.

📈 #Bitcoin's token circulation hit a 9-month high, revealing just how polarized traders have become with the #war. This circulation spike was similar to #BlackThursday back in Mar, 2020, where #crypto traders sold at the bottom at the beginning of #COVID. https://t.co/1XM82Asf4x pic.twitter.com/Z7gHJ7MY7F

— Santiment (@santimentfeed) February 26, 2022

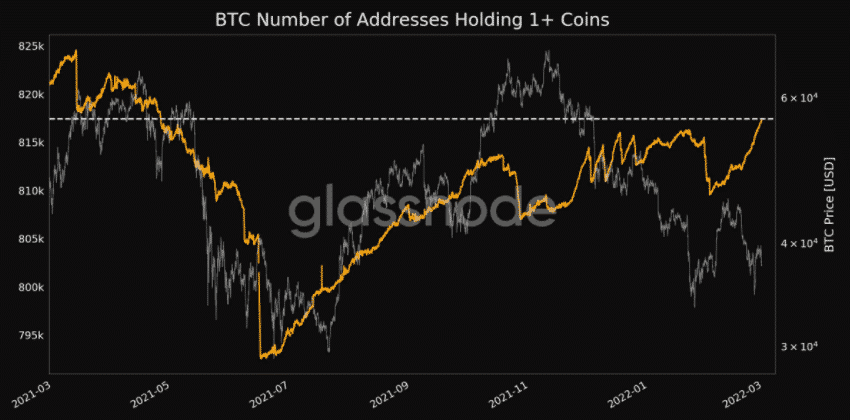

The charts are showing that these addresses show the retail investor’s behavior surged in late 2017 with the previous bull cycle and dropped shortly after as BTC started its retracement. They picked up the next year as well before hitting 35 million but Glassnode said they are set at about 40,276 as of February 28. it is not only the non-zero addresses that increased. Glassnode also informed that wholecoiners recovered from the recent decline and hit a 10-month high so now they are over 800,000 such wallets.

The world was shaken up recently when Russia attacked Ukraine in a special military operation following weeks of escalating tension. This is basically the first war in Europe for the past 70 years which sent the financial markets into turmoil. BTC lost about $5,000 in hours while the bearish signals were coming left and right. The uncertainity prompted most BTC investors to move their holdings and in similar situations, the retail investors tend to panic. However, this time they made huge transfers according to the data from Santiment.

The company observed the biggest amount of BTC transactions worth over $100,000 and $1,000,000 in about a month as BTC dropped below $35,000. Santiment said that the BTC token circulation hit a 9-month high and revealed just how polarized the traders became with the war. The BTC movement resembled the events of March 2020 when the world was introduced to the COVID-19 pandemic but the landscape seems to have calmed down after the war became evident. BTC recovered most of its USD value losses as well.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post