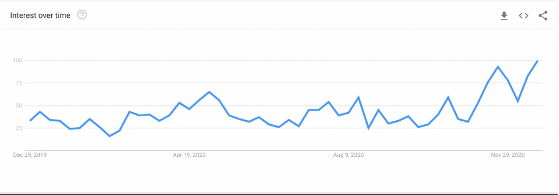

New Year Eve could see Bitcoin hitting $30,000 as it became a strongly bullish asset over the past few weeks. The benchmark cryptocurrency logged another record high over the weekend and hit $28,400 but later plunged slightly so let’s take a look at the BTC price news and analysis today.

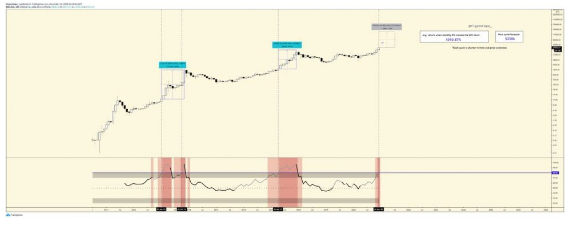

The bulls failed to push the BTC price to the psychological upside target of $30,000 while some profit-taking ensued and caused the cryptocurrency to correct lower to $25,772. The intraday bearish bias was short-lived as traders and investors flocked into the BTC market again with the price rebounding back to reclaim the support of $27,000.

Bitcoin’s retracement prompted a few analysts to see a bullish scenario as some pointed to the upside technical structure which is a bull pennant that is brewing on the shorter timeframe charts as the cryptocurrency starts consolidating. The technical setup projected bitcoin hitting $30,000 as its main target as shown in the charts. However, some have dissenting views and according to Michael van de Poppe, BTC looks poised for a downside correction because of its overbought status. He stated that the cryptocurrency could even drop to below $20,000 in the next selloff.

GREENPRO CAPITAL UP 133% IN PRE-MARKET; AFTER CO. ANNOUNCED THAT IT INTENDS TO SET UP A BITCOIN ($BTC) FUND FOR INVESTMENT

— First Squawk (@FirstSquawk) December 28, 2020

On the other hand, others expect that on New Year Eve, BTC will hit $30,000 because of the strong fundamentals and there are three reasons for this to happen. The first one is the enormous stimulus check that was passed on Monday that aims to bring economic relief to the people of the United States. BTC reacted positively to the news, the same as it did for the first stimulus money of $2.3 trillion. The cryptocurrency then retraced higher after Trump signed the bill which confirms that the traders and investors are seeing this stimulus event as bearish. But now, signs are turning and become a strongly bullish asset.

The other thing is the companies that invest in BTC making it find more reasons to grow its market cap. Another Nasdaq-listed company joined the Bitcoin bandwagon like Greenpro Capital that is actually a Hong Kong-based business intelligence company that announced it will raise debts worth $100 million to purchase BTC calling it a “reliable futures store of value.” The CEO CK Lee said:

“I’ve instructed our investment bankers to raise debt in Q1, 2021 of up to US$100M to invest in $BTC.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post