A new OKEx report shows that Bitcoin whales and institutions are buying low and selling high and take profits from their positions during the late 2020 rally so let’s read more in today’s bitcoin news.

A new OKEx report shows that the retail investors chased Bitcoin’s price once it headed higher in the past few months and whale traders as well, took profits buying the dips. OKEx partnered with the blockchain data company Kaiko analyzed the data from the most utilized trading pair on the exchange BTC/USDT with the two organizations followed by the performance from the beginning of August 2020 to November 30th, 2020.

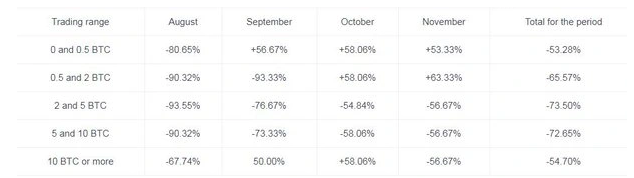

They separated the activity on the trading pairs into different categories. These include retail traders from 0.5 BTC and 2 BTC and 5 BTC between that and 10 BTC and 10 BTC or more like large traders, whales, or institutions. Despite insisting that the orders with 10 or more BTC come from bigger traders, whales, and institutions so the report admitted that it is actually harder to differentiate those as there are no strict levels for these types of traders. The behavior of retail traders was quite apparent during this period when BTC doubled in value. The charts below show the dominating trend per month which only shows small-size investors executing orders in October and November despite the increasing prices.

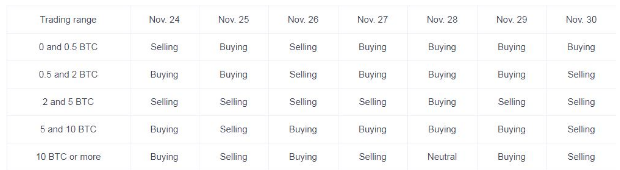

Retail traders kept adding more positions during the recent price surge. The result of this could be that the retail traders will be trapped in the short-to-mid term as per the reports. On the other hand, bigger traders who accumulated the bigger BTC portions around $10,000 decided to take profits during the rally. BTC and most cryptocurrencies didn’t have plenty to be thankful for since the entire market dropped in value in a matter of hours. The reports explored how the investor types acted between these developments so the paper even asserted that smaller traders panic-sold their BTC while the whales and bigger institutions purchased the dip. The situation repeated once again when the market started recovering:

“This table shows how everyone except the majority of retail traders took profits as BTC reached its all-time high on November 30th.”

OKEx and Kaiko outlined that the biggest differences between these traders said that “whales and institutions are in the business of buying low and selling high.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post