The latest cryptocurrencies news show that there has been a massive inflow of Bitcoin demand – and new institutional money poured into BTC which could help the coin rise above $10,000. It all started when the price crashed from $8,000 to $3,800 overnight which was one of the largest drops in Bitcoin history.

As we reported before, the Bitcoin halving event came just on time after this – when the amount of new BTC entering the market was cut in half. Around 87.5% of all the Bitcoin which will ever exist has already been mined.

All of this means that the remaining 12.5% of new Bitcoin will enter the market at a decreasing rate, which means that the new supply is dropping. But before we show the statistic that visualizes now hew institutional money poured into BTC changes the game, there is another interesting fact to point out.

11,580,00 bitcoin have not moved in over a year.

Even with a 85% increase in price during that time, those millions of bitcoin were not sold or traded.

Hodlers of last resort are insane. pic.twitter.com/KTpeDrLlOO

— Rhythm (@Rhythmtrader) December 1, 2019

Did you know that about 43% of all existing Bitcoin hasn’t been moved in over two years?

This shows that the demand for Bitcoin is very high and the Bitcoin price news may show interesting outbreaks in the future. So, the 50% drop in new supply definitely creates a huge shortage which will create a major increase in price.

The new wave of demand and new institutional money poured into BTC is not only going to help the price go above $10,000 – it will also help it reach new heights which are expected this year.

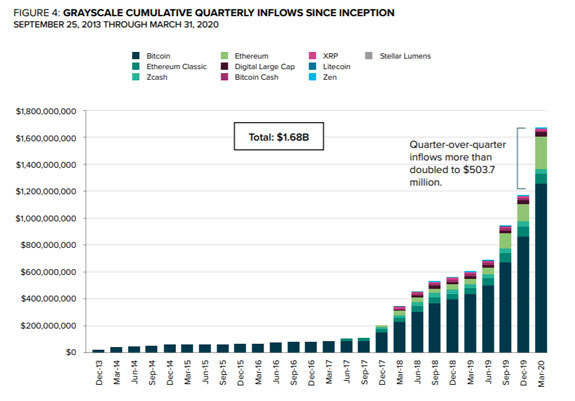

Institutions are entering the Bitcoin market and we are already seeing the start of this from crypto funds such as Grayscale, which currently owns about 1.6% of all existing Bitcoin out there. If we couple that with the new institutional money poured into BTC which is expected in the near future, we can see that the growth is only a clear sign of what the future holds.

For now, Grayscale owns around 1.6% of all existing Bitcoin (BTC). As the chart above suggests, new institutional money is being poured at a high rate and there have been more than $1.6 billion added to the market in the first quarter of this year (Q1 of 2020) alone.

So, based on the extreme supply and demand imbalance and how we have seen Bitcoin rallying before, $50,000 is definitely an achievable target and a quite realistic Bitcoin price prediction that we could see happening this year.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post