The new BTC indicator that predicted March’s 60% price crash starts getting bearish again as the cryptocurrency was caught between a crucial support and resistance every time BTC tries to break past $8500 or $10,000 will be rejected, as we are reading in the upcoming Bitcoin price news.

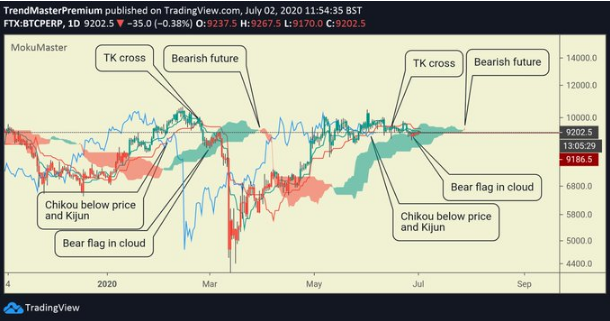

There is a growing sentiment that there will be another direction that Bitcoin will take or break according to a new analysis. According to traders, there’s a growing chance that bitcoin will correct rather than rallies in the months ahead and some share charts showing that per the one-day Ichimoku Cloud as Bitcoin showed a “bearish future” ahead. While one trader didn’t state it explicitly, the chart shows that according to the Ichimoku Cloud, Bitcoin looks similar to how it looked before the March crash from $9000 to $3700. The bearish sentiment of the Ichimoku Cloud is not the only similarity seen by the traders compared with the March’s charts.

Another crypto technician shared the image below two weeks ago and it shows that Bitcoin’s price action over the past 18 months along with the Bollinger Bands width. The new BTC indicator shows that there will be some more volatility in the markets. The last time when the width of the bands was low, was right before the crash in March. The traders are creating a net short position on Bitcoin through the CME futures and the same trader shared data from the CME’s Commitment of Traders report which is released every week.

The data shows that the institutional traders now hold about 2000 CME futures contracts short on Bitcoin. Negative sentiment from this group of investors was seen before the March crash to $3700. What these technicals and trends ignore is the different macro context now and back then. The analysts say that Bitcoin is much more bullish than before. BlackTower capital released a new report showing that the macro case for Bitcoin has been obvious and that the core of the sentiment is the existence of flaring geopolitical tensions as the pandemic causing to turn the world digital while the small markets are collapsing.

Nexo’s Antoni Trenchev said that due to the convergence of fiat money printing and the halving, bitcoin will hit $50,000:

“So yes, I’m sticking to my prediction of 50K until the end of the year. I appreciate that it is a bold statement, but the fundamentals are there and the momentum is shifting there as well.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post