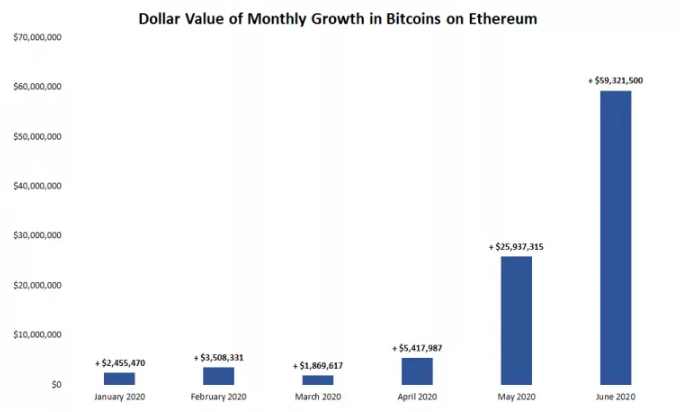

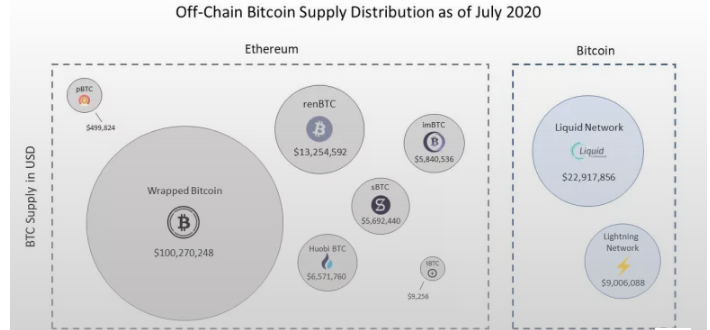

Nearly $600 million in Bitcoin were moved to Ethereum during June according to the data from Dune Analytics. Wrapped BTC which is the oldest tokenized bitcoin protocol on Ethereum is responsible for more than 75% of the growth after moving more than 4800 BTC to Ethereum in the past month, as we are reading more in the upcoming Bitcoin news.

The increasing demand for Bitcoin in the decentralized financial services as Ethereum continues to be the popular off-chain destination for Bitcoins and the yield farming and MakerDAO adding the tokenized bitcoin as collateral were the likely catalysts according to Medio Demarco, the ex-associate at Deutsche Bank:

“The recent trend shouldn’t come as a surprise and will probably continue.”

The increasing popularity of the tokenized bitcoin is not a surprise for the nearly $600 million BTC moved to the CTO of BitGo, Ben Chan, as the cryptocurrency payments processor that spearheaded Wrapped Bitcoin. Chan said:

“The purpose of WBTC is to bring bitcoin to the world of decentralized finance. Yield opportunities for lending and supplying WBTC” in Ethereum-based applications are driving recent growth.”

More than $132 million worth of Bitcoin is on Ethereum at the time of publication or more than $0.08% of the leading cryptocurrency’s market capitalization. Is the growth in demand for Bitcoin on Ethereum showing a positive sign for the number one cryptocurrency? According to Demarco, the trend is synergistic for both blockchains. Chan agreed, saying that for Etehreum, the growth in the value of assets on decentralized finance apps is a huge step forward in the maturation of transparent and trustless financial services.

For BTC, the benefits will come as users will become able to earn yield and collateralize Bitcoin which adds incentive for them to invest in cryptocurrency. Using BTC on ethereum could be bullish for both networks as Chan said. Also as reported, The historically low volatility proves that the BTC liquidity will slide again, as the consolidation channel that formed in May was narrowing down ever since. The cryptocurrency is doing some sideways trading between $9000 and $9300, facing a huge resistance at the upper boundary of this range. This trend will persist in the near-term as the data shows that Bitcoin’s 10-day realized volatility is now standing at 20%. The last time this metric was reached, was just before a huge sell-off in November 2018.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post