Morgan Stanley said Bitcoin’s 50% correction is not something new and that the slide is within its historical norms as the bank analysts said so let’s read more today in our latest Bitcoin news.

Bitcoin’s 50% drop from the previous high recorded in November is not something new and Morgan Stanley said that the slide is within historical norms according to a research note entitled “State of the bear market.” Estimating the fair value of crypto is difficult as they trade in a speculative manner which helped the large availability of the US dollars and central bank liquidity, the bank’s head of crypto Sheena Shah explained in the report published last week.

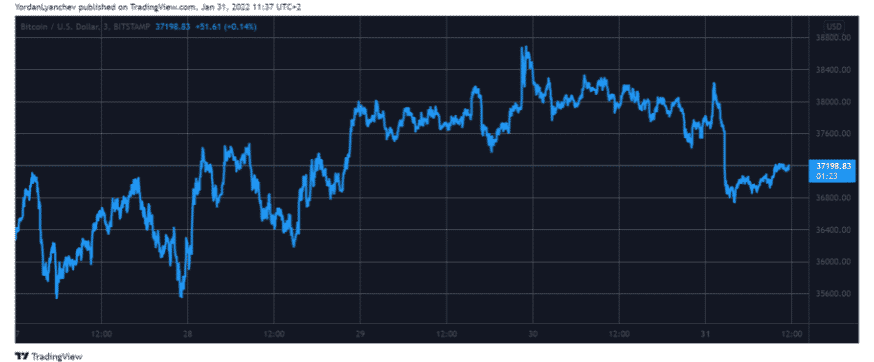

If BTC trades below $28,000, the market could expect further weakness as this is around the last year’s lows and on the upside $45,000 is the level to watch because this can suggest the recent downtrend could be turning around. The banknotes that BTC witnessed 15 bear markets since its creation in 2009 and the correction seen in the past months is within the range of what happened in the past.

buy vidalista generic buy vidalista online no prescription

Morgan Stanely said:

“Until bitcoin is commonly used as a currency for goods and services transactions (in the crypto or non-crypto world), it is hard to value bitcoin on fundamental demand beyond the asset speculation.”

The crypto investors could have to be patient if we are in the middle of a risk market correction as teh bank said. The leverage in the market will need to rise for a bullish trend to start as central bank liquidity is removed. The regulation, the NFTs, and stablecoin issuance are areas to watch in the upcoming new months as per the note.

As recently reported, Morgan Stanley is the global financial services giant which continues to increase its exposure to BTC via the Grayscale BTC trust. Morgan Stanley increased its bitcoin exposure as the financial services company held 928,051 shares of Grayscale’s Bitcoin trust. The recent filing with the US SEC showed that it purchased another 58,116 shares of GBTC on July 31st.

The data shows that at the time, the shares were worth around $34.5 per piece which means that the company is more or less even with the latest investment. It is also worth noting that this came a day after Dennis Lynch who is the head of Counterpoint Global at Morgan Stanley’s Investment Management said that bitcoin is not fragile.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post