The mining difficulty for BTC set a new peak recently along with the price and hashrate that are both surging as we can see in today’s Bitcoin news.

Both buying and mining BTC was getting tougher and according to the major mining pool BTC.com, mining has become the most difficult that it ever was. The mining difficulty for BTC or the measure that shows us how hard it is to compete for mining rewards is expected to reach 20.58 while the previous peak was reached in October 2020.

However, there’s a huge difference between the percentage which had lead to this record and the one that could lead us to a new record, cutting into the profit margins of the miners. While back in October, the difficulty made a step of 3.6%, now it is about to jump 11% all the way from 18.6T. It hasn’t moved this much since September 2020. But it also saw a huge drop by 16% which is the second biggest ever, right after reaching a previous all-time high. The mining difficulty of BTC is adjusted every two weeks in order to maintain the normal 10-minute block time but since the year started, it was moving between 8.1 and 9.6 minutes, recording 9.1.

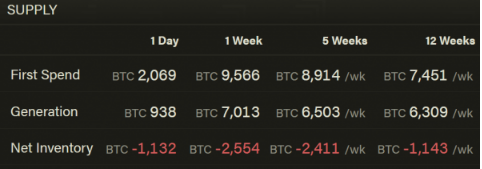

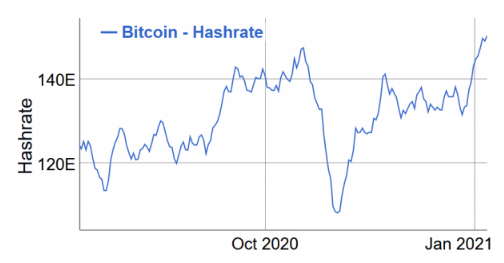

In the meanwhile, BTC’s price jumped 9% to $41,408, breaking the previous all-time high while overall it appreciated 41.5% in one week with a 125% increase in a month. In the meantime, the hashrate or the computational power of the network was rising as well and surpassed its previous record of 147.4 EH/s. Since the past difficulty adjustment on December 28, the hashrate increased by 12.7% to 150.3 EH/s. Miners were also spending more generated BTC than they were holding since, over the past week alone, they spent 9,566 BTC, and generated 7013 BTC.

The world’s leading cryptocurrency dropped by 7.45 percent in the Asian session on Monday and hit an intraday low of $36,565 before losing even more ahead of the European Trading hours. The sentimental shift owed to speculative traders that wanted to secure short-term gains close to the $40,000 price level. In the meantime, the global investors placed bets on the reflation trades given the increase in government bond yields. The yield on the cryptocurrency surged above 1.09 percent but the inflation expectations favor BTC even more. However, it seems that the market allocated their capital somewhere else as the cryptocurrency turned too risky to purchase it in the overbought levels.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post