The MicroStrategy stocks dipped in price and the company announced today that it purchased $400 million in BTC to add to the fund that it holds treasury as we are reading more in our latest Bitcoin news.

It also announced that those BTC will be held under a new subsidiary called MacroStrategy and the $400 million will allow the company to buy another 11,215 at the current price so as to raise money for that purchase, Microstrategy will return to its tricks and selling books. Bonds are debts people can purchase with a promise of receiving back the principal and interest. In this case, institutions can purchase debt in Microstrategy which the company uses to buy more BTC which it thinks will increase in value over time.

In the sale, Microstrategy is issuing senior secured notes that will mature in 2028, and in the previous bond sales, Microstrategy sold convertible senior notes with the basic difference being that these notes have an option to convert them into MSTR Shares. If the market is an indication, however, investors have soured on the company’s aggressive pursuit of BTC which left it with almost no cash in hand. Bloomberg noted:

“The private placement is $23 million higher than the company’s entire operating cash flow since 2016.”

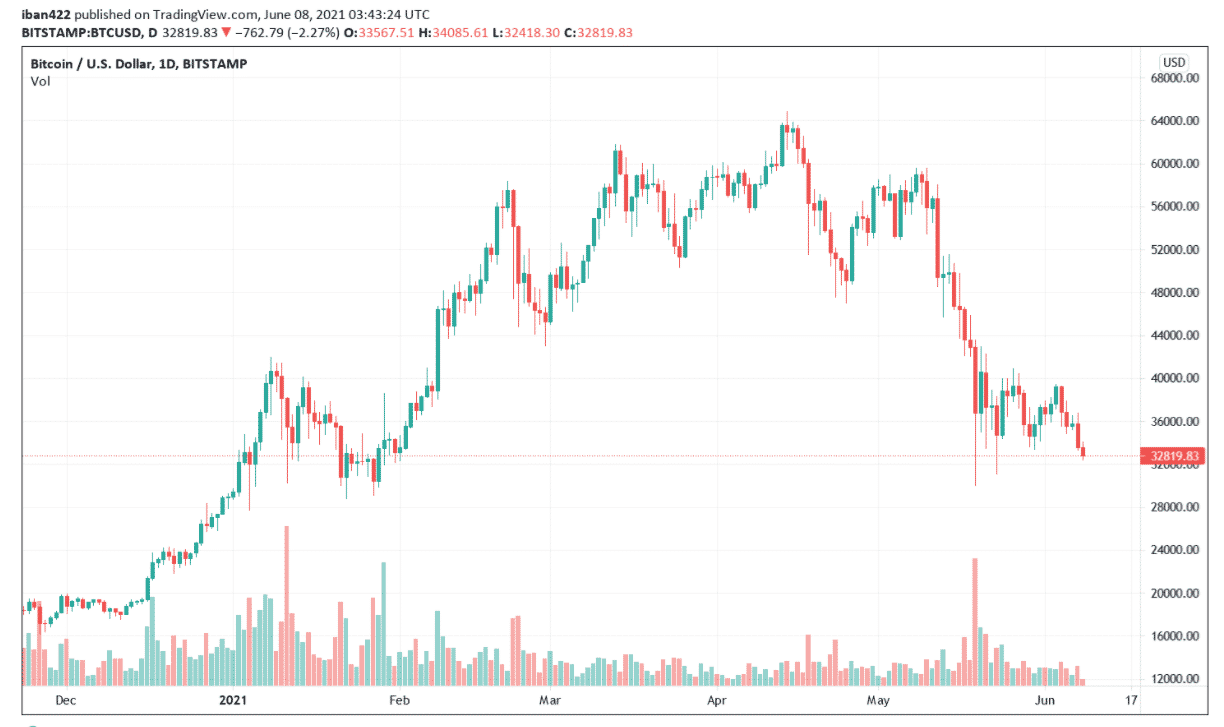

The company’s stock dipped 3% today and settled below $470 so the existing bonds took an even larger hit on the market and dropped in value by 9%. the $900 million in convertible bonds that were sold in February are now down to $66.2 according to Morningstar. Bloomberg described the corporate debt being issued for the latest BTC buy as junk bonds which means they are at a higher risk of default. Microstrategy also posted SEC filings on the website indicating that the company was taking a loss of $284 million based on the fluctuations in the market price of BTC during the second quarter of 2021.

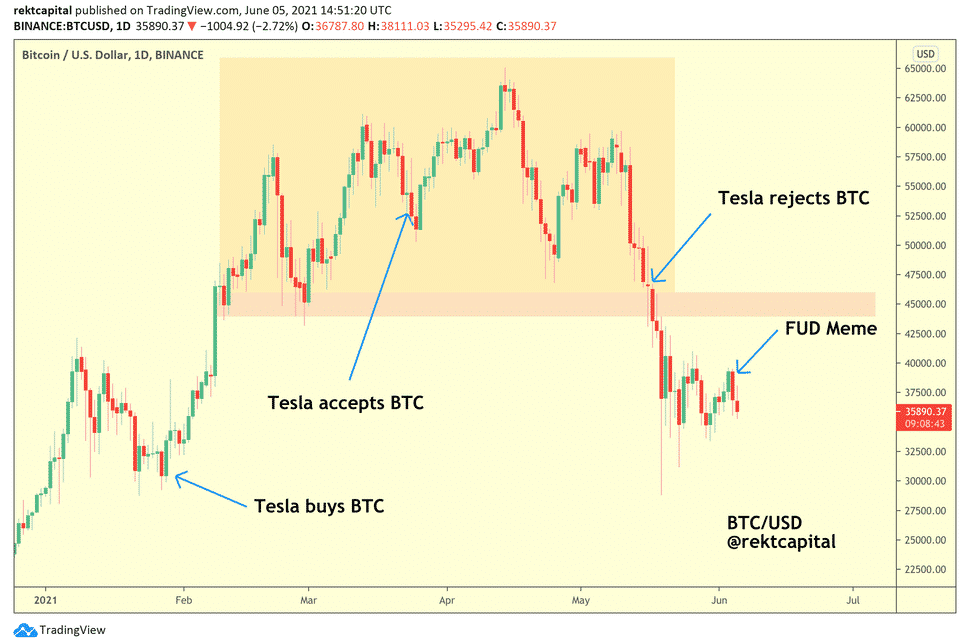

The price of BTC plummeted from its ATH of $63,501 to $35,600 and while some impairment of the loss is due to arcane accounting rules, it is also clear that MicroStrategy’s Bitcoin bet is not as profitable as once seen. However, Michael Saylor is not about to sell as he made it clear several times now, despite the microstrategy stocks dipping.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post