Microstrategy and Michael Saylor could be the biggest risk for Bitcoin while its price is in a precarious position after the major selloff that happened on the market. All whole this happened, the CEO of the company still continued with his BTC purchase and added to the corporation’s sizeable position but what can this mean for the number one cryptocurrency? We find out in our latest bitcoin news.

While there are a lot of market participants that are cheering the decisions of Saylor every time he tries to buy some more BTC, the more the company holds there is a risk that it will bring to the first crypto and its network, and here’s why. At the expense of going against the popular opinion today and the risk that comes along with it, there is a need to call more attention that is created for bitcoin thanks to Michael Saylor.

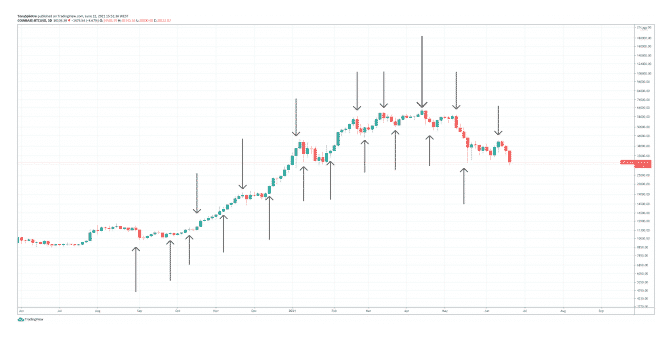

New MicroStrategy purchases now add systematic risk.

Without other comparable buyers, purchase confirmations are sell the news events.

— Charles Edwards (@caprioleio) June 22, 2021

The entire point of BTC was so that no third party or another actor could influence the network of money itself because even the creator of the coin, disappeared from existence because of this reason. The emergence of figureheads in the crypto space is new with the likes of Elon Musk coming out of nowhere and commanding masses of crypto holders as they listen. Dogecoin surged like Musk said but then came crashing down to reality and now there’s almost nothing to be done.

The impact of Musk cannot be understated because Tesla has nowhere near the position as Microstrategy because the company turned from a software solutions company to a crypto-exposure asset and it did well for its MSTR shares for now. Because Saylor kept on loading up on BTC over the past year, he is now at a loss on his purchase price and because he keeps adding more, he could become a target to whales who want to force the corporation to liquidate its positions.

Saylor stayed quite strong while Musk had a great time so the man still gets credit for his commitment to the crypto and its adoption. He is also a great guy and is spending time talking to people online about crypto and promoting more education and advocacy across the world. The problem is his lack of risk aversion that can lead to him and his company becoming a target. Because Musk turned also, there’s an example of the damage that can be done when it happens on record. So if Saylor is forced to sell, and turn his back on BTC how bad could things get?

Microstrategy and Michael Saylor could even be in the center of centralization because having that many coins in one man’s hands can have dangerous implications even with the best intentions.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post