Microstrategy’s CEO Michael Saylor introduced BTC to more than 6900 enterprises during the latest virtual conference organized by his company where there were more than 22,000 attendees gathered. Bitcoin yet again stole the spotlight during the event so let’s read more about it in today’s BTC news.

Michael Saylor introduced BTC and has a goal to bring it to as many enterprises around the world seems to be paying off as thousands of people are willing to listen to what he had to say during the virtual conference. It seems that his latest call was successful because the businessman revealed that more than 22,000 people registered for the Microstrategy World 2021 event where he discussed topics related to BTC as well as legal and financial perspectives for corporate strategies.

Of these 22,000 people registered, Saylor said that more than 8000 attended his “Bitcoin for corporations” program which means that about 6000 had an interest in listening to Saylor speak about the world’s biggest crypto and the potential for the market:

“ Our @MicroStrategy World 2021 was a great success, with 22,031 registrants. The #Bitcoin for Corporations program attracted 8,197 attendees from 6,917 different enterprises. All sessions are free & uploaded here, along with our Bitcoin Corporate Playbook.https://t.co/8KKB7m0EvK

— Michael Saylor (@michael_saylor) February 6, 2021”

The numbers reflect those who attended the live stream but Saylor wanted the message to get to everyone. He opened up access to his BTC lectures to anyone interested. The Corporate playbook and its approach to BTC are available for viewing and analysis. Saylor’s ambitions with the event were quite high but the audience exceeded his expectations. Before the event, the Microstrategy CEO was pleased with a strong response from the audience.

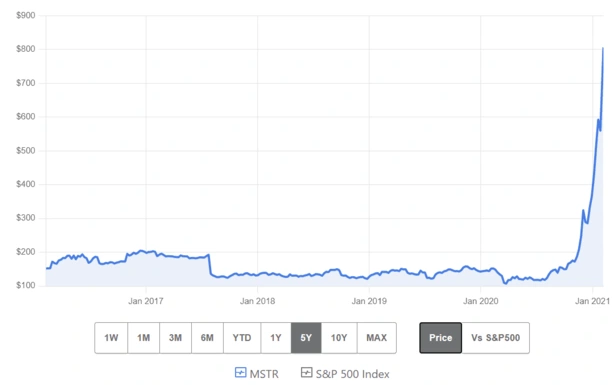

Michael Saylor became quite popular in the crypto space after a series of massive purchases of BTC as a part of his corporate strategy with the latest announcement involving the issuance of $650 million in debt to purchase BTC. This cost the company to score a downgrade according to Citi’s risk analysis but generated millions for the company in profit.

Once BTC started crashing, Saylor started buying the dip which increased Microstrategy’s BTC holdings when the holders started panicking and talked about a market crash. It’s not just his company because his own personal portfolio holds over $230 million in BTC according to recent disclosures.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post