Markets add $50B while Bitcoin and Ethereum soar to a 6-week high so now the market touched $1.1 trillion as we are reading more today in our latest cryptocurrency news.

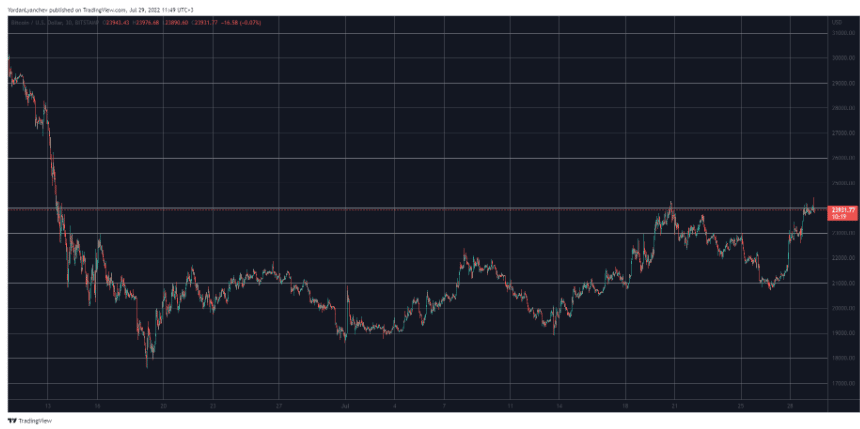

US President Joe Biden’s decision to refuse to admit the country officially entered into the recession pushed the market upwards once again and as a result, BTC, ETH, and most other assets tapped a multi-week high. The market is known for its volatility and BTC provided that in the past week. On July 20, the asset stood near $24,000 which was a local peak but then dropped by $4000 in the next few days to a low of $20,700.

The community expected more price fluctuations as the US FED was to announce the latest interest rate hike but the volatility indeed came unlike preivous time, BTC headed north. In a few hours, it broke above $22,000 and hit $23,000 so more news from the US pushed it upwards Joe Biden said the consecutive negative quarter in the terms of GDP is usually described as a recession which was not a recession. Bitcoin reacted with a similar price surge to $24,500 which became the new high price level since June 13 and as of now, it retraced a little but the market cap is above $450 billion.

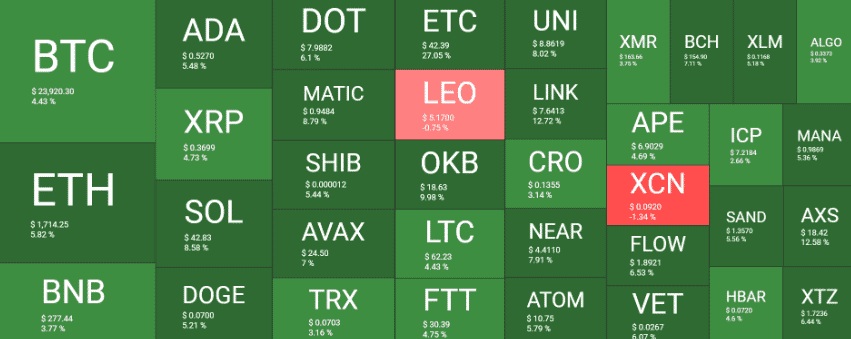

The alternative coins are well in the green once again and ETH leads the charge with a 6% increase to over 1700 a few hours ago, the second biggest asset traded close to $1800 a multi-week high of its own. Similar daily gains came from Ripple, BNB, SHIB, DOGE, ADA, DOT, and DOGE. Solana and Polygon are also up by 8%. Ethereum Classic is once more the biggest gainer from the larger cap altcoins and it surged by 27% and traded north of $27. The crypto markets add B in one day and now it is at a local peak as well as .

buy cialis daily online blackmenheal.org/wp-content/themes/twentytwentytwo/inc/patterns/en/cialis-daily.html no prescription

1 trillion.

As recently reported, The FED raises the interest rate by 75 basis points and lifts the target range of the benchmark interest rate between 2.25% and 2.5%. The move was met with the expectations of analysts that predicted the FED will lift the interest rates this month and less than a week ago, the ECB shocked the investors as it raised interest rates for the first time in almost 11 years which was a huge interest rate hike of 50 basis points.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post