The market fluctuates while Bitcoin remains stable after the series of events that came crashing down on the market, from BitMEX charges to Trump’s COVID-19 diagnosis so let’s find out more our latest bitcoin news.

The Bitcoin price remained steady at the $10,542 level despite the money-laundering charges against BitMEX and the TRUMP Covid-19 diagnosis. After the price drops, it still remains one of the least volatile major cryptocurrencies. Right now, the major crypto market action happens in most DeFi protocols into which the investors poured in more than $10 billion over the past 4 months. Despite the charges of money-laundering against the BitMEX exchange and Trump’s positive COVID test, the price of the number one cryptocurrency held steady over the day while decentralized finance coins are still on the rise as the Defi boom continued.

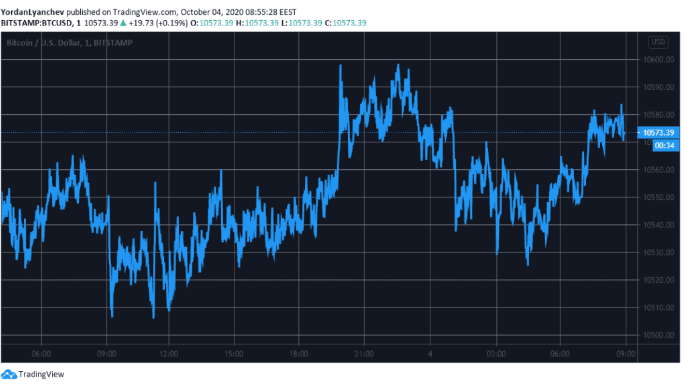

The current price of BTC hit $10,542 according to the data from CoinMarketCap. It started the week at $10,900 but dropped by $400 on Thursday. It managed to recover before falling by further $200 on Friday when the CFTC filed charges against BitMEX with money laundering accusations and when Trump caught the coronavirus. As the biggest crypto by market cap, about five times the size of the second biggest, Ethereum, BTC’s price is a strong indicator for the health of the crypto market. over the past day, Bitcoin’s daily price increase of about 1 percent seems quite insignificant when compared to other coins but Ethereum increased by 2.5% over the day and Binance coin increased by 3.5%, as the market fluctuates still.

Bitcoin comes out ahead if you look into the weekly charts as it fell by 1.4% while ETH dropped by 0.76% and XRP by 2.4%. Polkadot dropped by 4.9% and Chainlink by 11%. More volatile are the coins that power leading decentralized exchanges. Balancer for example increased by 9% over the past day and the interoperable protocol Ren increased by 16%. Aave increased by 8% and SNX by 8%.

The market cap of each is trivial to the one of Bitocin but all together combined represent a booming industry into which the investors poured in about $10 billion in the past four months. The rise can be linked to investors’ increased appetite for risk as DeFi protocols offer high-interest rates and lucrative incentives in their governance tokens.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post