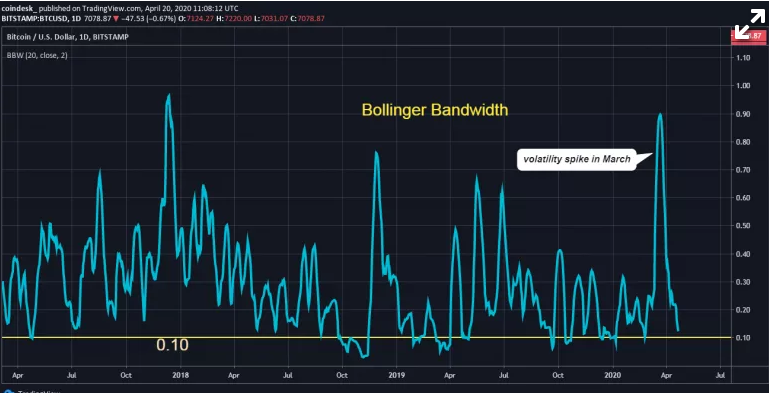

The market awaits a huge price move as the Bitcoin volatility hits a three month low thus making a price squeeze which could pave the way for a bigger move on both sides as we are reading in the bitcoin news below.

The spread between the BTC Bollinger bands show two standard deviations above and below the 20-day moving price average, and it seems to be narrowing to $895. This level is the lowest since January 6 when the price spread was $635 according to the data. Bitcoin spent most of the past two weeks trading between $6,450 and $7,450 and the range narrowed down further to $7,000 and $7,300. The tightening between the Bollinger bands is considered to be an advanced indicator of an impending big move as the market awaits. Chris Thomas, the head of digital assets as Swissquote said:

“When it tightens, it is because we have been consistently trading in a narrower range for a prolonged period and we should see a breakout very soon.’’

The Bitcoin price volatility exploded and followed the ranges from October 2019 and January 2020. Some of the other volatility indicators also witness a sharp decline over the past few weeks. The Bollinger bandwidth as it was calculated between the bands by the 20-day moving average can be seen increasing from 0.11 and 0.90 during the first three weeks in March.

A level below 0.10 has marked an end of the price consolidation period and low volatility space. With the metrics standing at 0.13 we could see bitcoin trading without a clear directional basis for a few days. The volatility situation in the Bitcoin options market seems to have stabilized as the one-month implied volatility is hovering below the 77 percent level according to the data from Skew. The options traders are in buy mode when the volatility drops below the lifetime average and aims to sell when the volatility reaches bigger highs.

The crypto markets declined over the past few weeks because of the Federal Reserve’s asset purchase program and the fiscal stimulus by the US government which was worth trillions of dollars. However, the markets are still having a hard time since the number of coronavirus cases is rising around the world. The coronavirus death toll surpassed 40,000 over the weekend and more than 744,000 infections are reported which is raising doubts over the readiness of the nation to reopen the economy.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post