Long-term holders continue accumulating despite the recent BTC market crash and it seems that the whales are following and remaining unfazed by the market downturn so let’s read further in today’s latest bitcoin news.

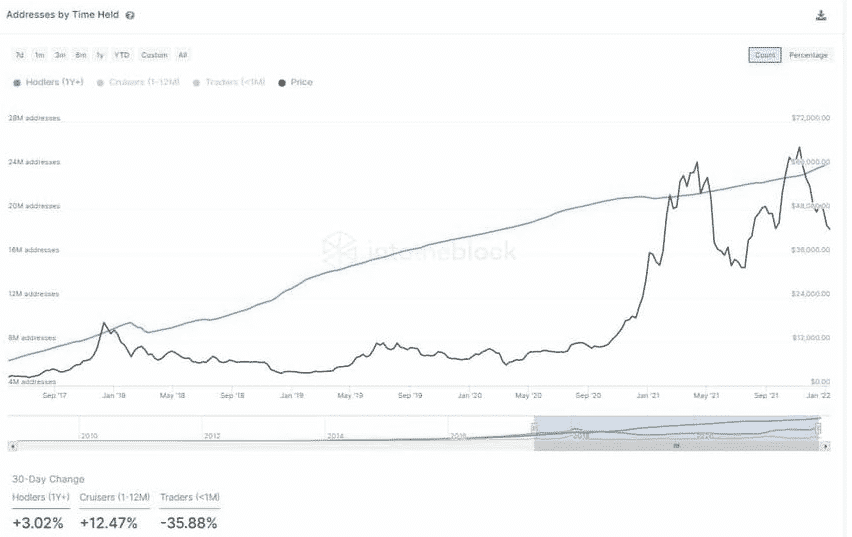

The long-term holders didn’t mind one of the sharpest drops since July 2021 as the market corrected by 52%. while the macro bear scenario is in play, some indicators show how long-term investors remain unfazed by the news and they continue accumulating. The data from IntoTheBlock classifies as holders’ addresses that were holding an asset for an average time of one year and the growing long-term investors suggest that the belief that the asset will retain or increase the value over time is a key characteristic of the store of value assets. In BTC’s case, the number of holders increased regardless of price volatility and manages to increase through the correction despite the crash seen in March 2020.

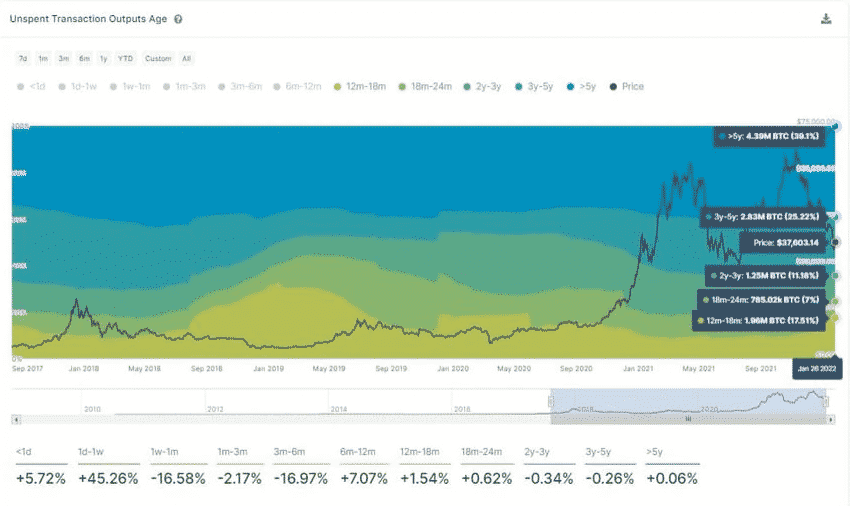

Even as the price of BTC suffered a huge drawdown like the last 30-days the number of holders increased by 3.02% and the above statement is only reaffirming when analyzing the percentage of not moved BTC. The Unspent Transaction Outputs Age Indicator measures the volume of transactions being created and classifies these by time frames so the UXO Age Indicator segments the number of tokens as per the time that it has been since they last moved from one address to another. The amount of BTC supply that hasn’t moved in 12 months is reaching 60% which is higher than we saw during the March 2020 crash.

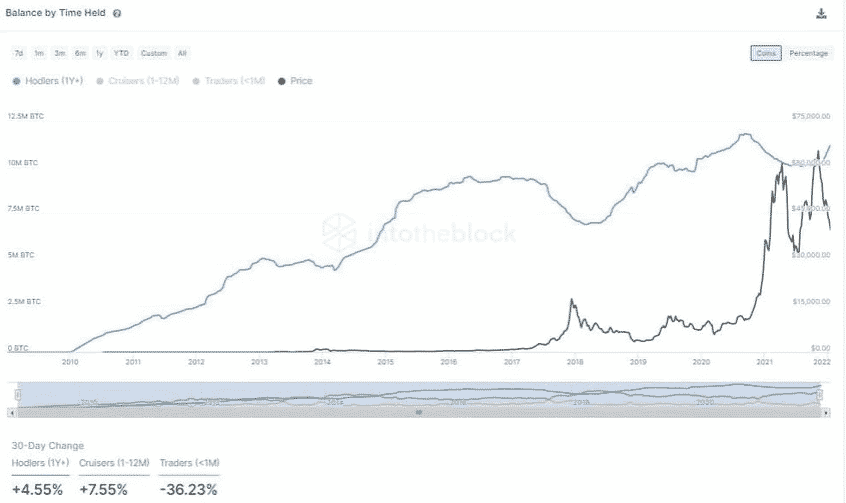

It is becoming clear that the holders remain unfazed by the price movements but the next question to be asked is are they accumulating still? The charts show the balance of BTC for passive investors that have held the asset for more than one year and track the accumulation pattern in different stages of the BTC cycle. With most of the retail buyers getting scammed during the March 2020 crash, the addresses accumulated 1 million BTC until October 2020.

They sold a small portion of the holdings in 2021 and they now started accumulating again as BTC continued its drop. In just 30 days, the addresses increased their holdings by 4.55%. the holders increased their holdings and the accumulation pattern is evidenced by the growing volume held by addresses that hold 1K to 10K BTC. Addresses with more than this amount are mainly institutional players or whales. These addresses often lower their holdings after huge rallies and wait to buy at lower levels. The volume held by these addresses increased by 1.03% in 30 days and increased their holdings by 5.26m BTC.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post