Long BTC traders pile up while Bitcoin struggles and hints at lower levels during the latest trading session so let’s read more in today’s latest Bitcoin news.

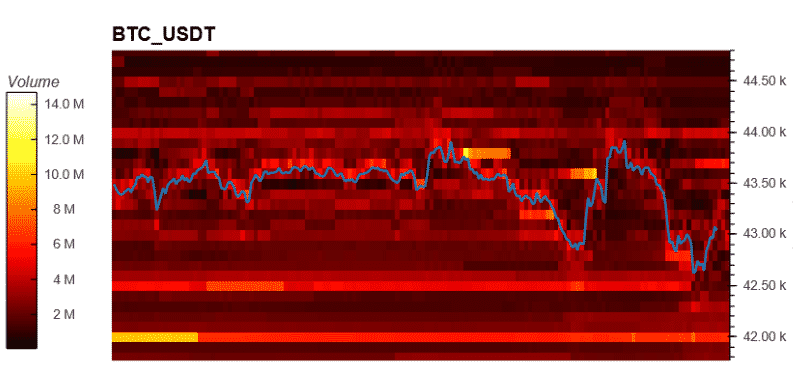

The benchmark crypto was rejected at $48,000 and was unable to reclaim the previous highs. At the time of writing, the long BTC traders pile up as BTC trades at $43,100 with a 1% and 5% loss in the past day and last week respectively. The data from Material indicators recorded little support for the BTC price as it moves in a tight range between the $42,000 and the $43,500 levels with Bitcoin losing the bid orders that can absorb the future downside price action. As the charts show, BTC had about $10 million in bids orders which were pulled as the crypto trended to the downside and this liquditiy seems to have been distributed between $42,000 and $41,500 that can stand as the last line of defense against the latest hit by the bears.

The charts show how the entity places strategic asks orders when the BTC price tried to reclaim the preivous levels. This happened as the investors with asks orders of $100,000 pushed the BTC price back down to the low $40,000 with the biggest sellers of the price action seeming to be retail investors and the investors with the ask orders of $10,000. the only investors with orders of $1000 seem to show an interest in buying into the BTC price.

The above mentioned suggests a huge entity trying to push the BTC price down to accumulate BTC at optimal levels and the distribution of liquditiy first concentrated at $42,000 then distributed between the levels and $40,000 which seems to support the thesis. BTC whales often employ the method to trap retail and to obtain liquidity to take the positions with the smaller investors seeming to have taken the bait. The analyst Ali Martinez showed an increase in the number of long positions which are taken on the Binance exchange. The long/short ratio stands at 70% for the long traders and 29% for the opposite side of the trade. The analyst commented on the following ont eh implications for BTC’s price. BTC can be preparing for a liquidation cascade and about 70% of the trading accounts on binance futures are now net-long on BTC which could result in a long-squeeze so BTC can go down to $42,000 and $41,000 to collect liquidity.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post