The latest BTC narrative could pose a threat to the multitrillion bond market as one Australian investment fund Pendal Group believes that government bonds will become obscure if they continue to lose their relevance in portfolios run by central banks since investors are pushing for Bitcoin lately. In our latest Bitcoin 2020 news, we are reading all about it.

Vimal Gor, the Head of Bond, Income and Defensive Strategies commented on the matter:

“We think ultimately that government bonds will turn into a dead asset class, so we now have to imagine what it will be like for other assets classes when bonds are no longer relevant to hold in a portfolio.”

According to Gor, the latest BTC narrative will make bonds stay low for a long time since investors are looking for other alternatives and commodities as well as crypto assets that will play a huge role. However, he said that BTC becomes superior to gold as a social contract and store of value because of the opportunities it offers like flat running costs, ease of transaction, and the finite supply:

“We have been positioning in gold for our clients for many many years now. Now we’re doing it with bitcoin.”

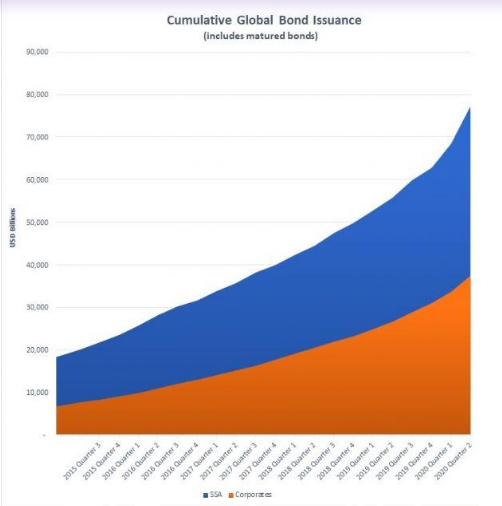

Gor said that a lot of the high-net-worth clients and the wholesale investors are looking for BTC but that the fiat currency system will continue to evolve. The overall size of the global bond markets in USD terms is about 3.

buy synthroid generic buy synthroid online no prescription

3 trillion according to the International Capital Market Association. Rick Reider, the chief investment officer of Global Fixed Income said that Bitcoin is now much more functional than gold and the most popular crypto asset could even replace gold. BlackRock had $7.4 trillion in assets under management in 2019.

With some of the AUD 101.4 billion in funds under management in 2019, Pendal Group says that it is one of Australia’s biggest investment managers. The company is listed on the Australian Securities Exchange. Su Zhu, the CEO of crypto investment company Three Arrows Capital commented on Pendal’s approach:

“If pensions begin divesting from the zero/negative yielding global sovereign bond market to buy BTC that would be a veritable deluge of capital.”

Michael Saylor, the CEO, and Founder of the business intelligence company MicroStrategy expected BTC and other crypto assets to strengthen the position as a better store of value for the $300 trillion which are now crashing in bonds, stocks, and real estate.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post