The key BTC metrics show bears are running on fumes despite the institutional BTC outflows of $55 million as we reported about in our recent bitcoin news.

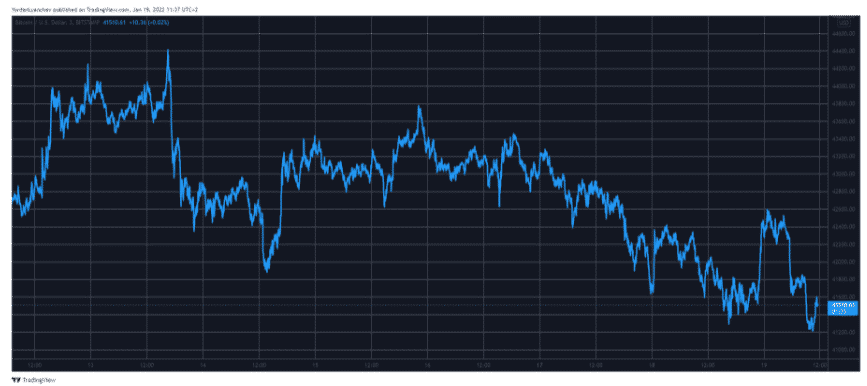

The Key BTC metrics show quite a gloomy picture and contrary to the analysts warning that BTC could dip to $38,000 before a breakout, CoinShares and Arcane Research suggest that the tide could be turning slowly. Bitcoin institutional outflows were negative four out of five weeks and totaled $55 million. The total assets under management fell to a three-month low of $35 billion last week. The CoinShares findings show that larger investors in the BTC ecosystem like Grayscale, CoinXBT, ProShares, and ETC Group reduced their exposure to the asset.

Their actions are compounded by fear and green index hogging the extreme fear dial for two months as the BTC spot buying volume reached a six-month low. If the fear and greed index entered a third consecutive month of fear, it will be the second time to do so in the metric’s existence. Traders are also cautious. According to Arcane Research, the seven-day average real BTC trading volume is set at $3.4 billion and it is the lowest figure since July 2021. Investors and enthusiasts in the crypto space will remember that following this moment, the BTC price swelled by 60% which was buoyed by robust institutional investment. With Bitcoin’s 30-day price volatility constrained to the lowest level for twelve months at 2.

buy lexapro online http://petsionary.com/wp-content/themes/twentytwenty/inc/new/lexapro.html no prescription

5%, the spring is preparing.

The Twitter analysts clamor for an upside reaction as one BTC bull @GalaxyBTC told followers that $80,000 is on the horizon while some say the bottom is in for the nth time.

As recently reported, Bitcoin traded in a tight range this past week which provided a relief to the market participants after the volatile start of the year and the crypto was mostly flat over the past 24 hours and up about 3% over the past week compared to the 5% gain in ETH. Some traders and analysts remained careful despite the recent price bounce off $40,000 earlier this week.

Many crypto market analysts think the bottom is in for BTC and ETH after their terrible start to the new year. BTC increased by 6% from this time a week ago and ETH is up by 10% since then. It has been the case, however, that the altcoins are doing much better in this new year. Not too long ago, it was rare to see a lot of projects surge while BTC and ETH remain stagnant.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post