JPMorgan Executives say that the demand for Bitcoin increases and now, most clients see it as an asset class as we are reading more in our latest Bitcoin news today.

One of the JPMorgan Executives Mary Callahan Erdoes, says that the clients see Bitcoin as an asset class and demand crypto services more and more. While being skeptical about offering BTC investment options to the clients, the American investment bank JPMorgan Chase & Co admitted that the demand for the asset class increased dramatically. Mary Callahan Erdoes who is the JPMorgan director of Asset and Wealth Management noted that the company’s clients see bitcoin as an asset class. To maintain the client base, Erdoes stated the bank will continue providing crypto services to customers to meet up with the growing demand:

“A lot of our clients say, ‘That’s an asset class, and I want to invest,’ and our job is to help them put their money where they want to invest.”

Earlier in February, the bank’s co-president and COO Daniel Pinto said there was no demand for BTC at that time but now the clients have an unfading appetite for the crypto asset which the banking giant is trying to satisfy. Erdoes pointed out that the institution still has reservations about deciding to categorize crypto as an asset class considering that they are quite volatile:

“It’s a very personal thing. We don’t have Bitcoin as an asset class per se and time will tell whether it has a store of value. But the volatility you see in it today just has to play itself out over time.”

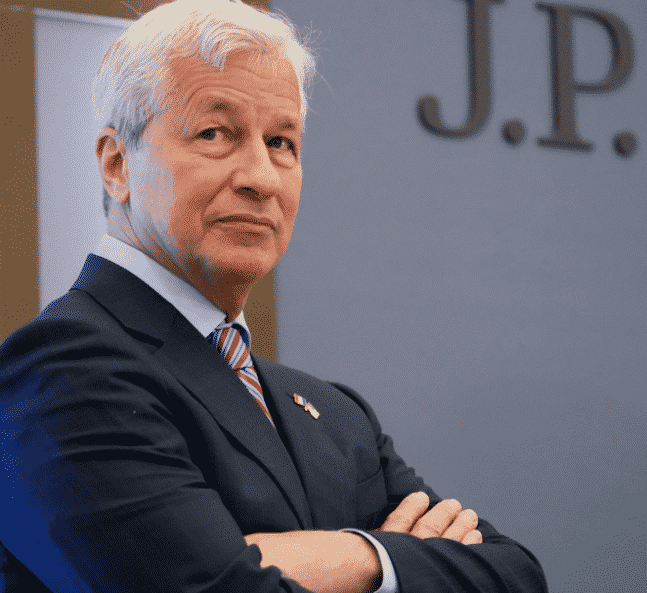

In the past, JPMorgan didn’t like crypto, especially BTC. Earlier in 2017, the company’s CEO Jamie Dimon blasted BTC and called it fraud, and threatened to fire his employees that deal with it. However, he changed his stance now and revealed that he regretted calling the crypto fraud and praised the blockchain as quite the revolutionary technology. The company became crypto-friendly since and launched its native crypto back in 2020. earlier this year, JPMorgan started hiring ETH and blockchain experts as it continues to explore this technology. In April 2021, the Wall Street bank planned to launch a BTC fund for private clients with the NYAG. Despite trying to become friendly to the blockchain, Dimon was not able to stop himself from dishing out the negative comments about BTC but then warned people to stay away from the asset and crypto markets overall.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post