Institutions buy on the BTC Dip still despite the near-term volatility according to the on-chain data that we have in our latest Bitcoin news today.

Bitcoin’s price was on a roller coaster this week and deleted most of its 2021 gains on Thursday but according to the on-chain data, the institutions buy on the BTC Dip continuously despite its volatility and the near-term bearish market sentiment. The data from the on-chain data site Glassnode shows the number of addresses with 1000 or more BTC continued increasing this week while its price dropped below $30,000. The count of these addresses dropped in late December and spiked again since the start of 2021.

The number of the total BTC transactions on the network is still high according to the data from South Korea-based company CryptoQuant. The ratio of BTC transfers involving all of the exchanges to all bitcoin transfers network-wide didn’t go up, indicating that most of the transactions were done via OTC deals as a preferred approach by institutional investors. One example of a big buyer during a dip happened on Friday once MicroStrategy announced that it purchased 314 more BTC for $10 million in the latest market sell-off. Ki-Young Jun who is the chief executive at CryptoQuant said:

“Only 7% of network transactions are used for exchange deposits and withdrawals. 93% of transactions in the Bitcoin network is used for non-exchange transactions like OTC deals.”

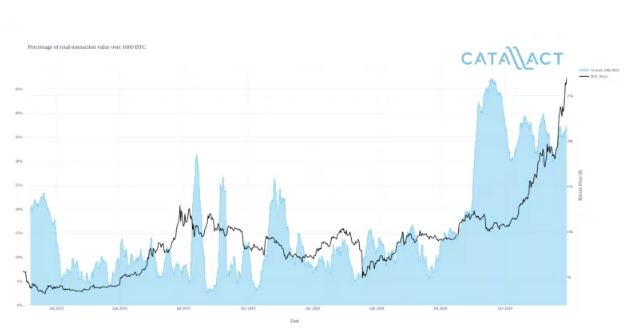

Buying the dip behavior by institutions like MicroStrategy is not something new. According to the OKEx data, the research branch of the exchange showed that the institutional investors didn’t use the wait and see approach once the prices started experiencing high volatility last year. The percentage of the on-chain transactions over 1000 BTC hit 45% in September and remained high from above 5% in June 2020:

“Institutional investors really piled into the bitcoin space after Paul Tudor Jones announced his entrance, and they didn’t stop as 2020 came to a close. Additionally, we can assume that institutions were on the bidding end of the spectrum and buying large amounts of BTC – as opposed to selling – since the price of the leading cryptocurrency rose in a parabolic fashion throughout Q4 2020.”

The price volatility is due to the “over-leveraged” traders and retail investors that found themselves “weak-handed” as per the OKEx Insights editor Adam James. He said:

“There is little reason to assume institutional interest in the bitcoin space will suddenly disappear in 2021. Because institutional investors tend to have longer time frames in mind when investing, they are unlikely to be phased by January’s price decrease and potentially happy to make investments at lower prices.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post