According to one indicator, if history repeats itself, BTC could see a parabolic explosion as it saw some mixed price action as of late with the bulls having a hard time controlling the trends in the time following the rally to $28,500. In our latest bitcoin news, we are looking into the price analysis some more.

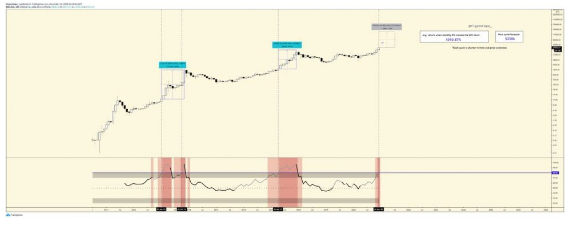

The rejection was quite intense and still has to show signs of strength in the time after it happened. The fact that the bulls protected the asset from seeing more drawbacks it is positive because it invalidates the possibility that the recent high is a blow-off top. One trader noted that there’s actually a bullish indicator that is flashing for BTC. He pointed out to the crypto’s monthly RSI noting that the close above a specific level is nearing and it is usually followed by parabolic moves higher. These movements had an average return of 1.010% but their size seemed to get smaller with time.

BTC and the rest of the market dropped slightly in the past 12 hours which seems to be the direct result of the pressure which XRP is placing on the market because of the latest Selloff. Where will the market trend in the mid-term not depend on XRP As many think but the latest round of selling pressure could see a strong reaction from investors. One analyst noted that Bitcoin’s monthly RSI is flashing bullish signs for where the number one cryptocurrency will trend next.

At the time of writing, BTC is trading down at just over 1% with a current price of $26,700. The cryptocurrency has been trading in the upper $26,000 region and the lower $27,000 region in a mixed price action, over the past few days so it could be garnering more support to break above the strong resistance in the lower $28,000 region. One trader explained in a tweet that it could be on the edge of seeing a parabolic move higher in the days ahead, pointing out to the monthly RSI as an indicator of this chance if history repeats itself and we await to see a parabolic explosion:

“BTC – Monthly RSI. Monthly candle is about to close above 80. When this happens, bullish trend continues, with an avg.

buy viagra professional online herbalshifa.co.uk/wp-content/themes/twentytwentytwo/inc/patterns/en/viagra-professional.html no prescription

return of 1010.87%. Each cycle is shorter.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post