Holding BTC is dangerous now according to David Tice who is a seasoned investor for managing the Prudent Bear fund, as we read further in our latest Bitcoin news today.

Bitcoin did well over time but according to David Tice, holding BTC is dangerous for your portfolio. Bitcoin’s drop to levels of $30K made investors cautious and warnings of a bearish force and beginning to emerge once the markets are already losing about 50% of the total capitalization since the ATH a few months ago. Among the bearish voices is David Tice, a popular investor known for managing the Prudent Bear fund until he started selling in the 2008 crisis.

In an interview for Trading Nation, Tice is known as a pessimist in the space and warned about the dangers of investing in BTC under current conditions. He explained that Bitcoin’s rise to $60,000 was quite dramatic from this point of view and a correction was needed but the attention from authorities and central banks contribute to the increasing aversion of potential institutuional investors that created a downward price pressure. There’s been more of an uproar from central bankers like the Bank of England and Bank for International Settlements making profound negative statements which are why he thinks it is very dangerous to hold it.

Tice makes bearish calls during a bull market and the analysis tends to go more to the fundamental side and in this case, regulatory uncertainty, China’s crackdown, and what else makes the market a dangerous place for BTC holders especially those expecting a short-term rebound. He also explained that under current conditions, BTC fails as a store of value mechanism so he recommended investing in gold or stocks of companies related to the industry. According to him, in addition to the natural appreciation of the gold due to irresponsible government practices, investing in mining companies can be profitable:

“I would be owning gold, especially gold and silver mining companies. These companies have never been cheaper … But then you add on what we think is going to be a 20% annual increase in the gold price, and these companies are going to be outstanding opportunities.”

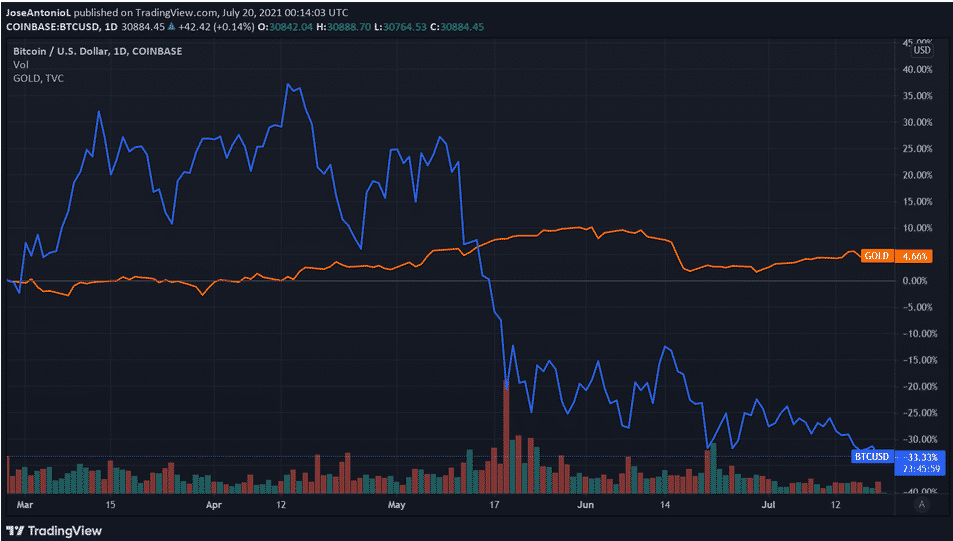

He could be right in the short-term and when comparing BTC vs Gold, the precious metal has outperformed the crypto since the second quarter of 2021. it is important to note that the coin spiked almost 800% between 2020 and 2021 but did crash over 50% since then. Gold, on the other hand, went up 21% at the same time which proves its store of value.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post