Grayscale’s BTC trust will convert to an ETF while the premium remains negative, so what does it mean for the traders? Let’s find out in our latest BTC news.

Earlier this week, Grayscale Investments announced plans to transform Grayscale BTC Trust into an exchange-traded fund and GBTC was one of the only funds for retail investors and institutions alike. With the growing competition, the fund’s high management fees and lock-up periods lost favor to many investors. GBTC even continued trading at a negative premium which means that the funds were trading below the BTC price.

In late 2020, GBTC premium increased to a 50% high due to the surge in institutional demand for cryptocurrency. the premium hit a low of 14% last month and this drop was likely because of the wake-up call Grayscale needed in order to turn the outdated investment product around. The investment company stated that it was 100% committed to converting the BTC fund into an ETF. Grayscale’s BTC trust will convert to an ETF as the company already applied for one with the US SEC back in 2016 and 2017:

“[T]he regulatory environment for digital assets had not advanced to the point where such a product could successfully be brought to market.”

Bitcoin’s institutional interest was sparse but with Canada approving the ETF earlier this year and Fidelity joining the race, the time seems perfect for Grayscale to revamp its GBTC. After the announcement made a few days ago, GBTC rallied 5% as the premium bounced from 9.32% to 3.78% because of the renewed confidence from institutional investors. The premium dropped back to 8.35% and institutions closed their leveraged positions as their 6-month lock-up period was finally over.

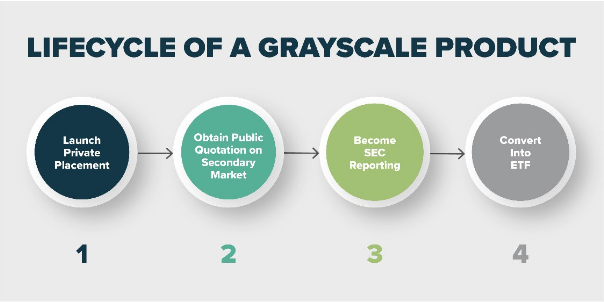

As reported recently, The world’s biggest cryptocurrency asset manager Grayscale announces plans to convert the GBTC trust into a Bitcoin ETF with the company even filing documents with the US Securities and Exchange Commission which indicated that it completed all steps before a transition occurs. Launched in 2013, Grayscale is a digital asset manager that enables institutional and accredited investors to receive exposure to BTC and other cryptocurrencies without having to worry about managing the holdings and storing them. The company enjoyed the past year with a strong increase of its assets under management which is above $45 billion.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post