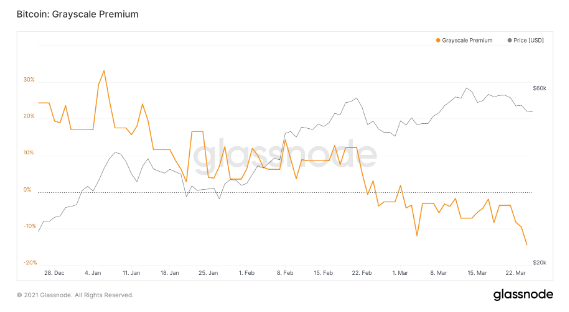

The Grayscale BTC trust GBTC premium has just dropped to an all-time low after trading at negative for about two months, it finally crashed by -14.21% this morning as we can see in our latest Bitcoin news today.

GBTC has traded at a high premium relative to the underlying cryptocurrency with an average of 15.02% premium since the fund’s inception. As competition grows and companies are looking for cheaper and accurate financial products, GBTC’s appeal dropped to an all-time low. Back in 2020 when BTC prices doubled, investors wanted to pay a huge premium to gain more exposure to the major cryptocurrency. This resulted in an increase in inflows and led to the number of GBTC shares skyrocketing to 692 million at the time. However, the fund doesn’t allow redemptions or conversions which means that the shares can only be created and never destroyed.

This was not a problem when the GBTC market demand allowed for a strong increase in the supply but with BTC’s rally now falling behind, there’s an overt imbalance between the supply and the demand which is further enhanced by institutions taking profit while their six-month lock-up period’s end. Another reason why the Grayscale BTC trust GBTC premium continued dropping is because of the launch of new BTC-based financial products and exchange-traded funds. Major investment banks like Morgan Stanley and Goldman Sachs started offering BTC-futures products at the start of 2021, and other banks showed interest.

Yesterday we saw Fidelity filing for its own BTC ETF to US investors and with the high fees and massive slippages breaking the fund’s credibility, GBTC will lose out to other efficient funds. The president of advisory company ETF Store Nate Geraci said:

“The unpleasant truth for GBTC investors is that competition erodes demand for the product, which can lead to a collapsing premium or even a discount.”

Grayscale’s BTC trust is still the leading Bitcoin find with an estimated AUM of $11 billion but it’s only time until the fund becomes obsolete. As reported a while ago, Grayscale’s BTC trust traded at a discount compared to its otherwise high premiums as the data from multiple sources shows. The product allows institutional and accredited investors to bet on the Bitcoin prices and to hold a small amount of BTC per share which are then traded on the open market or can be found on a subscription basis.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post