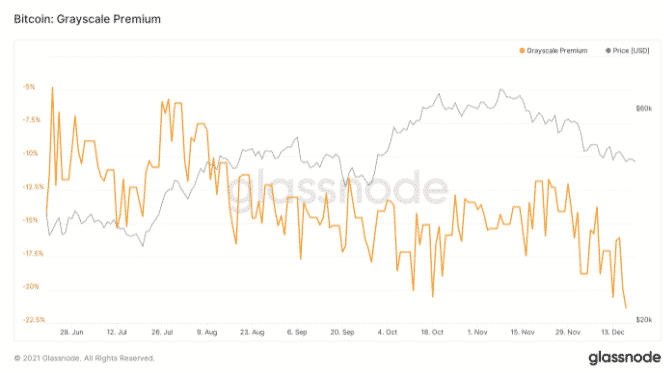

The Grayscale Bitcoin Trust reached its biggest discount ever and its product is now trading at a 21.36% discount, the largest in the eight-year-long history so let’s read more in today’s Bitcoin news.

The Grayscale Bitcoin trust reached the biggest discount ever and closed the previous week with a record discount of 21.36% according to the data from Glassnode. This means that the new investors can buy GBTC shares at prices dramatically lower than the actual market value of BTC while the existing holders will face losses because of the six-month lock-up period of the initial investment. According to the company, the GBTC shares price dropped by 3.46% and recorded a $43.77 price tag per share.

We're grateful for your support in our ongoing effort to convert Grayscale Bitcoin Trust into an ETF! $GBTC @Coinbase #Bitcoin https://t.co/kVIa7uSSpC

— Grayscale (@Grayscale) December 16, 2021

However, with each GBTC share amounting to 0.00093202 BTC, the actual price of the stock is $34.42 in BTC which is down by 5.21% from the past trading sessions. The discrepancy between the two prices changes reveals the effects of the discount. GBTC is a closed-end fund that means it cannot add or remove shares easily to accommodate inflows and outflows. The share price is determined by supply and demand rather than the underlying value of the assets as will be the case with the traditional ETF.

Launched in 2013, the Grayscale Bitcoin trust is the most popular product of Grayscale Investments and allows investors to trade shares in trusts that hold larger pools of BTC. GBTC holds over $30 billion in assets under management. GBTC shares traded at a huge premium relative to the market price of BTC but the price of the stock turned negative at the end of February following the launch of other BTC-exchange traded funds in Canada. Grayscale believes that the best way to reverse the current discount is to convert GBTC into the full-fledged Bitcoin ETF, arguing that a spot BTC ETF will be in the best interest of the investors.

The company also filed a formal application with the US SEC to convert GBTC into an exchange-traded fund that is backed by physical Bitcoin in October. Last week, the SEC rejected all attempts of launching a product of this kind into the US market and delayed a decision on both Bitwise BTC ETF and GBTC. According to the commission, it needs another 45 days to review the proposals. Before that, the SEC rejected other applications for a Bitcoin ETF that were filed by the New York-based ETF issuer WisdomTree.

Despite the many setbacks, the demand for the ETFs by actual BTC remains something that most US exchanges like Coinbase confirmed last week when it endorsed plans for a GBTC conversion into a Bitcoin ETF.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post