GBTC delivers better returns than Bitcoin ETFs over the past week and it seems that the flagship fund had no competition from the newly launched ETF products as we are reading more in our latest Bitcoin news today.

Bitcoin investment vehicle the Grayscale bitcoin Trust outperformed the newly-launched exchange-traded funds a week ago as the data shows. Figures shared by Grayscale executives confirm that GBTC delivers better returns than the Bitcoin eTF product form a week ago. While the talks continue to revolve around BTC futures ETFs and their market impact, Grayscale is biting back. Amid the claims that the newly-launched funds are sucking custom away from GBTC as the company’s chiefs were quick to note that the latter was a better idea since launch day. Over the past week, GBTC returned around 8.8% while the Bitcoin futures ETF ProShares’ BTC strategy ETF dropped 0.5%.

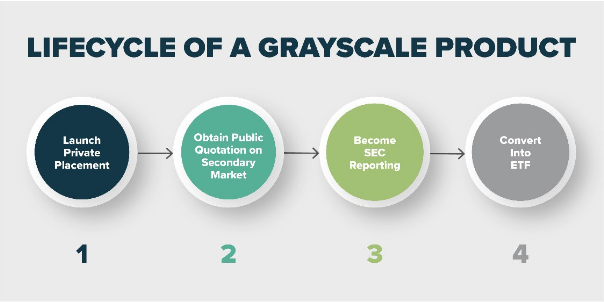

This was thanks to the part of the GBTC premium heading higher and reached a low discount to spot the price since early September this week. The concerns centered on Grayscale’s potential inability to rescue the negative premium as more ETFs get laucnhed, this countered by those that argued that the two instruments’ value proposiotn can’t be compared. Barry Silbert, the CEO of Grayscale parent company digital Currency Group outlined the GBTC higher trading volumes and these totalled $374 million while BITO managed $286M. Grayscale CEO Michael Sonnenshein repeated the pledge to convert GBTC itself into an ETF and applying to do so with the US regualtors.

In the meantime, Tuesday saw the launch of the third US BTC ETF and this time it was for VanEck. The long locked in a battle with the SEC over bringing a product to the market, the release marked a line in the sand for the longest time market participants. The fate of the physical BTC ETFs that actually delviered, still hangs in the balance ahead of the SEC decision on the first app next month. VanEck director Gabor Gurbacs argued:

“If regulators cared enough about the best interest of investors, they would approve a physical Bitcoin ETF soon. 14 countries in Europe, Canada, Brazil and other nations have access to physicals Bitcoin ETPs. Physical > Futures.”

Popular trader and analyst Scott Melker countered that the ETH futures ETF will precede the physical BTC green light.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post