FOMO starts again as Bitcoin adoption rate exploded to the highest level since the previous parabolic peak as we are reading more in today’s bitcoin news.

2020 was surely the year of Bitcoin as no other financial asset acted as a better safe haven than the benchmark cryptocurrency. Bitcoin was and still is the top-performing mainstream investment asset in terms of return of investment. The FOMO starts again and will only increase from here since there’s also a sudden surge in interest around crypto which is reflected in the asset setting the highest number of new BTC addresses that were created since 2018 since the bear market started.

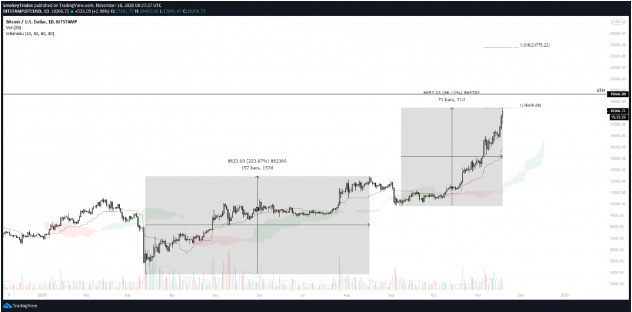

Bitcoin is a usual asset compared to gold and stocks as well as traditional markets but one technical analysis charts them in a linear scale showing that Bitcoin grows by the network effect and the price increases also over its lifetime, especially when price discoveries take place. The network grows higher when other users participate via mining or keeping the network secure as well as contributing to hash power. When a user purchases BTC a wallet is created so existing users can also create additional wallets if they wanted to. These addresses and the rate at which they are created can be very helpful in understanding the consumer adoption rate.

If BTC addresses are climbing, this is a sign that new users are coming at a fast-growing rate. According to Glassnode data, the rate at which a new BTC address is created matched a figure which was not seen since 2018. The reason that this is important is due to the fact that the metric reached a new level that is on par with the crypto bubble speculation. When BTC broke the $10,000 range in 2017, in only a few weeks it hit $20,000 and retail investors immediately wanted to jump on board which is why the number of newly created addresses increased.

Where is the crypto market currently, is not near to the 2017 level of interest. Bitcoin however still captures the imagination of the media and the mainstream public.

buy suhagra online https://paigehathaway.com/wp-content/themes/twentynineteen/inc/new/suhagra.html no prescription

This time around, Google Searches reflect the average people that purchased the last time are now unaware that bitcoin could hit all-time highs again. Once the record is broken, another flood of FOMO could enter. Institutions are still buying BTC and there are even celebrities joining aboard. Billion-dollar hedge funds, as well as companies, are buying BTC but this could leave very little of the scarce BTC supply left for retail investors if they decide to get heavily in.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post