Flash crash tanked the gold markets as the prices dropped below $1700 per ounce this morning while Bitcoin holds strong, as we can see more in today’s Bitcoin news.

Gold prices tanked during the Monday morning Asian trading sessions and compounded losses accumulated over the past week. The price of gold fell to its lowest level since March with the flash crash tanked the goal markets and led the price below $1700 per ounce. According to Tradingview, the price of the precious metal dropped to $1690 per ounce during Asian trading hours on Monday and the price did post a slight recovery later while changing hands for $1742.

How the hell was I asleep for this flash crash in Gold 😳😭😭😭 pic.twitter.com/2Foy7WiOwB

— Chairman Everything-Will-Pump ☝🏾™️ (@chairmanlmao33) August 9, 2021

Gold is down by 4% in the past seven weeks and 8.7% since trading above $1900 per ounce at the end of May. The metal retreated 8% in 2021 so far and it is now down by 14.6% from its August 2020 ATH of below $2040. Forex trader and chart guru Peter Brandt attributed the crash to the wholesale liquidations and stated:

“This has all the finger prints of a bank/brokerage house conducting forced liquidation upon a huge leverage speculator.”

He noted that the leverage ratio on the CME exchange gold markets is roughly 15 to 1 and suggested a heavily leveraged group of traders driving the price action for gold. Analysts at London trading firm City Index blamed Monday’s crash on stop-loss-related selling in thin market conditions.

buy zydena online https://paigehathaway.com/wp-content/themes/twentynineteen/inc/new/zydena.html no prescription

The United States unemployment figures were a major catalyst for the drop in commodity prices a week ago and the unemployment rate dropped more than expected to 5.4% from 5.9% which is a new low of the pandemic era as per the Bureau of Labor Statistics report. The broad US economy is healing still as City Index concluded:

“The better jobs data sent the US dollar and US bond yields higher, never a good formula for commodities.”

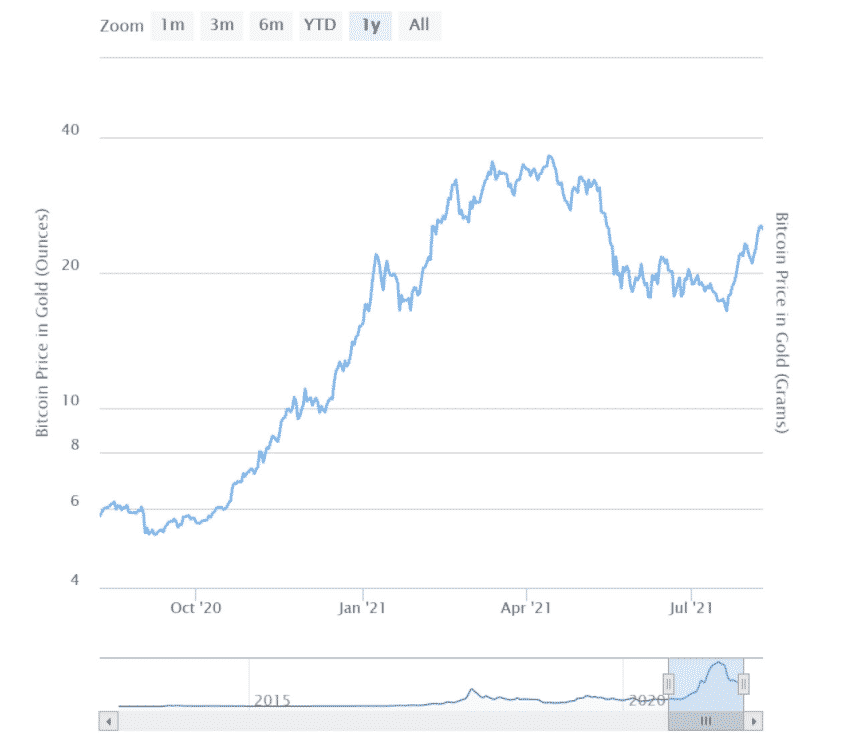

With one BTC being worth about 25 ounces of gold, BTC is down 28.5% from its ATH Against gold with one single BTC having been worth 35 ounces of gold during the BTC ATH nearly $65,000 in mid-April. 1 BTC was worth 15.5 ounces of gold at the start of 2021 and at the time of writing, BTC slumped 2% over the past 24 hours to trade at $43,667.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post