The FED raises interest rates by 75 basis points in an attempt to get inflation under control and as a result, BTC surged 5% so let’s have a closer look today at our latest cryptocurrency news.

The FED raises the interest rate by 75 basis points and lifts the target range of the benchmark interest rate between 2.25% and 2.5%. The move was met with the expectations of analysts that predicted the FED will lift the interest rates this month and less than a week ago, the ECB shocked the investors as it raised interest rates for the first time in almost 11 years which was a huge interest rate hike of 50 basis points.

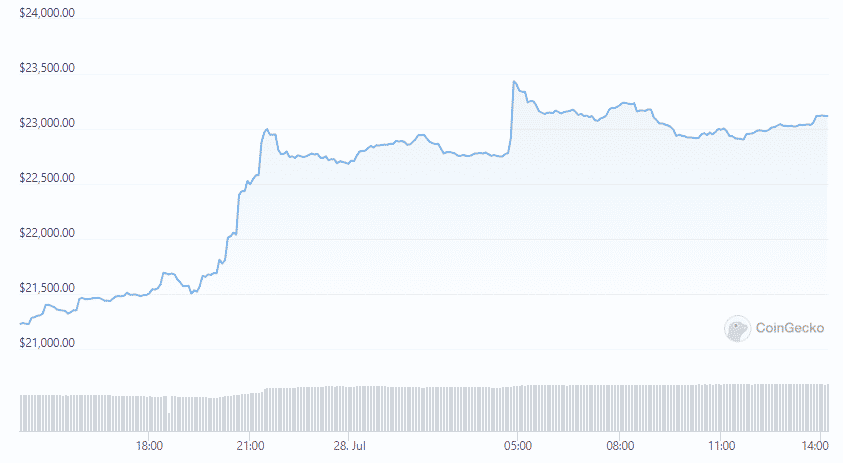

Ahead of today’s meeting where the FED made the announcement, the stock market and the crypto markets saw some relief and major stock indexes were up by 1.39% and the NASDAQ was up by 2.48% alogn with the Dow Jones Industrial Average at 0.3%. Bitcoin and Ethereum were up over the past 24 hours and increased by 5.4% and 12% respectively. Bitcoin jumped by 3% in the past few hours after the announcement while ETH increased by 4.8%. however, they both saw a decline in the first week and the total value of the cryptocurrencies dipped below $1 trillion earlier this week.

The central banks across the world were raising the interest rates to restore price stability and get inflation under control. In the US, the FED delivered its steepest interest rate hike since 1994 which is increasing at the latest pace in over four decades. The central bank is trying to get inflation under control before it collapsed the economy. If the Fed gets too aggressive in tightening the economy, it could push the US into recession and that’s why they were issuing forward guidance and communicating the outlook on the economy and potential policy to influence the market expectations.

The depository institutions such as banks maintain balances with the FED and the fund’s rate determines how expensive will it is for them to borrow from and lend to each other with these funds. The rate hikes had a ripple effect on the financial system and made it more expensive for businesses and consumers to take out loans and cool down the economy by diminishing the demand. With the interest rates dampening the growth prospects for companies on Wall Street, the institutional investors were swapping stocks and crypto for secure investments like corporate bonds and US Treasuries which have no upside than the riskier investmetns but have been gained back by the federal government.

The crypto market struggled in the face of the tightening economic policies and the prices crashed around the release of inflation reports. The FED had a dual mandate of maintaining full employment while still keeping the prices stable and with a goal of 2% inflation each year.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post