ETH and BTC prices crash 5% thanks to troubles with Kaisa and Evergrande with the rest of the equities and cryptocurrency markets going down so let’s find out more in today’s bitcoin latest news.

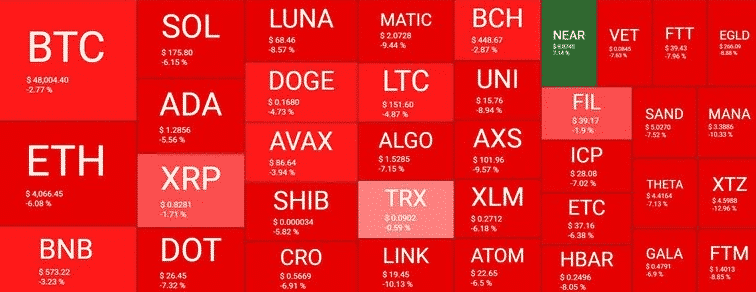

Just when things started looking better for investors, the crypto markets headed back faster than the Chinese home sales. The ETH and BTC prices crash 5% in the past day as the total cryptocurrency market cap was deleted by 6% of the value according to the data from Coingecko. The stock prices were trending lower after the Chinese real estate developers Kaisa and Evergrande were unable to make a scheduled UK dollar bond payment.

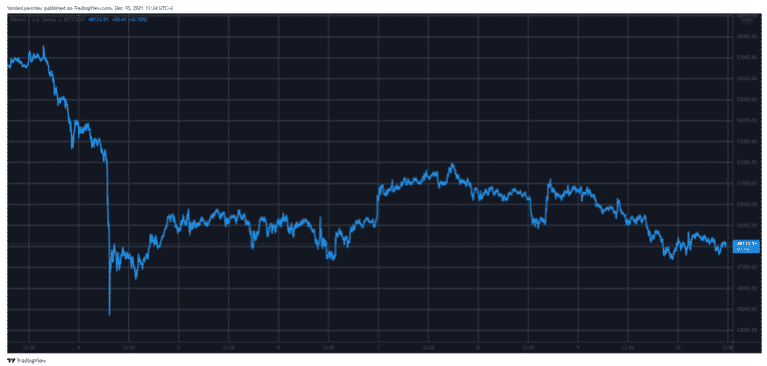

Bitcoin is having a slow December as the top cryptocurrency asset by market cap started the month above the $57,000 mark but then dropped below $48,000 and it is the same story across most of the crypto coins. Ethereum traveled from $4700 to below $4200and the total crypto market cap deleted $250 billion since the start of the month. The bulk of the losses occurred on Friday when BTC’s price dropped 17% in a few hours. Since then it managed to get some gains before dipping slightly a little today again.

The selloff had multiple causes such as investors in derivatives markets having their positions liquidated which only created a cascading effect on liquidations. These liquidations started because crypto was broadly moving in tandem with the equity markets as it has done this year already with stocks being down on Omicron worries and Federal Reserve policy changes so BTC followed suit. This is the case again though the Dow Jones Industrial Average as an index of shares of 30 US corporations was flat so the NASDAQ dropped more than 1% and the S&P500 started reversing gains from earlier this week.

The US markets could be reacting to the troubles affecting the biggest property developers in China which were unable to cope with the declining home sales and the government restrictions on the loans. Kaisa defaulted on $400 million bonds while China Evergrande Group missed the final interest payment deadline a week ago. Given the overlap between world economics, should we expect another financial crisis? While Bitcoin positioned itself as a hedge against inflation, the injection of institutional investors into crypto made the markets a little less immune to movements in the other markets.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post