Deutsche Bank goes against BTC in the latest market crash of 50% while historically institutions always were the biggest skeptics of BTC and crypto as an asset class as we can see more in our BTC news.

The event at the height of the 2017 bull run, most institutions remained quite doubtful of the crypto emergence and the ability to become mainstream. The roaring start of 2021 saw BTC Climb over 300% during its ATH which led to an influx of institutional investors and other victories like Coinbase’s NASDAQ debut where BTC seems to be gaining bitcoin’s support.

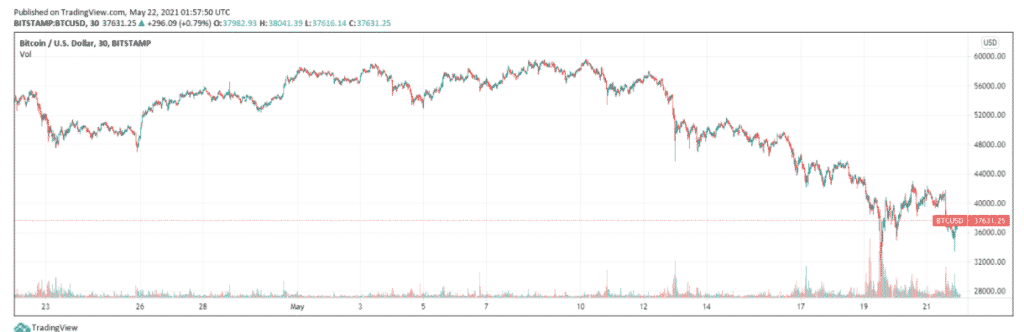

After the recent developments in China banning crypto mining and Tesla reverting the decision to accept BTC payments, BTC and the rest of the market continued to drop to lower lows and in the past month alone, BTC is down 48% with ETH and other altcoins crashing even lower. Deutsche Bank goes against BTC as well with its bearish stance on cryptocurrency. In a note published earlier, analysts from Deutsche Bank published a note titled “Bitcoin: Trendy is the last stage before tacky.”

One analyst even criticized the crypto for its susceptibility to selling pressure and said that all it took for the cryptocurrency to drop out of style was one tweet and a Chinese government statement. The note said:

“Those few words caused Bitcoin’s value to plummet from nearly $60,000 in the days before to below $48,000. Next on Tuesday, the PBoC reiterated that it will ban digital tokens as a means of payment causing BTC to drop just above $30,000 at one point-its lowest value since January.”

Another concern was raised due to BTC’s lack of transactional utility. The bank argued that the lack of liquidity failed to justify the high valuations and the legitimacy as an asset class. The value of BTC is based on wishful thinking, said the bank. Now with governments and central banks seeking to impose new regulations on the growing industry, there could be even less room for growth. China’s central bank is set to launch its own digital Yuan in place of crypto by next year.

It’s important to note that financial institutions like banks such as Deutsche are often reactionary. A few months ago, we saw Goldman Sachs and Morgan Stanley offering BTC products to investors and the crypto’s prices increased threefold.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post