The Bitcoin halving event which reduced the block size to 6.25 BTC for miners has apparently created many side effects. Now, at five days after the halving, we can see that the market is reacting. While yesterday we mentioned how the BTC hash rate dropped by 36% post the halving, today we can see that the demand for Bitcoin spikes.

If you are wondering where does all of this come from, there has been a research by Arcane Research and a crypto data provider, which found that despite investors’ concerns over the block reward halving that are compromising the security of the network, the demand for BTC continues to rise globally.

One proof of the increasing adoption and demand for Bitcoin is supported by the total number of functioning Bitcoin ATMs all over the world. Currently, we can see that there are 8,000 operational ATMs around the globe, which is a more than 90% increase since 2019. The Bitcoin ATM operator Coinstar also reported a 40% increase in Bitcoin ATM use since February this year.

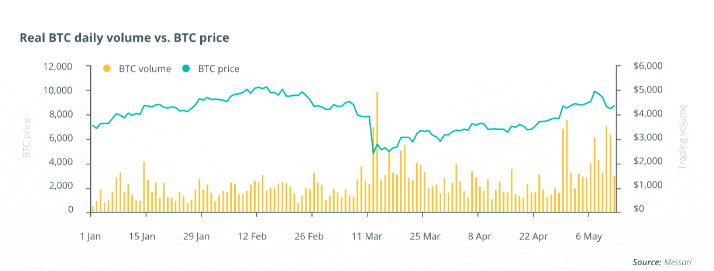

If we compare BTC to other coins in the altcoin news, we can see that it continues to lead in terms of market capitalization – with more than $10 billion daily transactions volume. The figure eclipses Ether (ETH) and Litecoin (LTC) which are both seeing increased daily transaction volumes below $500 million – but are far from Bitcoin.

The demand for Bitcoin continues to rise. Currently for the month of May, the price of BTC is up by nearly 10% whereas altcoins such as Ripple’s XRP token and Monero (XMR) are hardly breaking event. So,, there is some correlation between the BTC price going up after the halving event.

But the big question is – will this continue and can we see a Bitcoin price at an all-time high this year – even with the falling BTC hash rate?

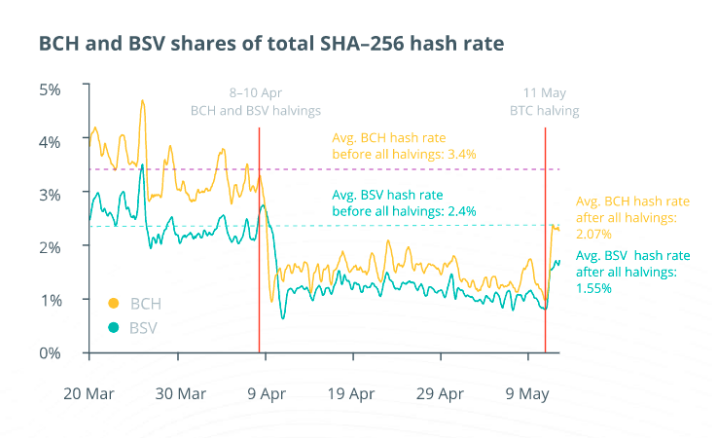

According to Arcane Research, the halving on May 11 left miners shifting back to Bitcoin Cash (BCH) and Bitcoin SV (BSV) networks, but both of these networks have seen drastic drops in their share of total SHA-256 hash rate.

All in al, the demand for Bitcoin spikes and could extend in the following months – which coincides with the rising price which is a trend that is likely to continue, according to this research.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post