The latest DeFi induced bullrun pushed the Bitcoin price past the $11,500 level as sentiment metrics show that it is still undervalued as we are looking into it some more in our bitcoin latest news today.

The DeFi induced Bullrun pushed the entire crypto market upwards the past week with Ethereum, Bitcoin, and other bigger cryptocurrencies giving more gains of about 10-15 percent to the investors. The data feed from the quantitative on-chain data provider proves the aforementioned as the sentiment metrics are paving the way for higher prices. The data on The Tie, the provider for alternative data for digital assets that shows the investor perceptions on hundreds of crypto assets, shows that Bitcoin is in bullrun action in both short and mid-term trades.

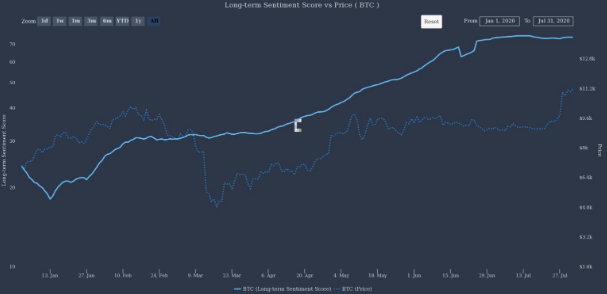

The charts show that the long-term sentiment score for the BTC price shows that the latter started to catch up with the public perception of the crypto asset. The sentiment remained stable once Bitcoin suffered the “Black Thursday” crash when the prices dropped by over 45% in two trading sessions. The public perception grew since. Looking at the data, Bitcoin still has converged in the long-term public sentiment but the “gap” still remains that shows BTC is undervalued. In the meantime, the charts show that the Twitter-verse is showing the dominance of 42% as the prices go up. This can be attributed to the rise of DeFi and ethereum and other DEX-based altcoins in recent weeks, as all three surged 1000x in a few days.

The US citizens purchased a huge chunk of $67 billion worth of cryptocurrencies during the first part of this year and the numbers mean an average purchase of crypto of $4000 per person but this figure is still less than the previous one of $111 billion or $7000 per person. The US leads into crypto adoption showing that countries in America had a 15% penetration of digital asset investments in 2019. The leaders are developing other markets as well like Brazil and Turkey as citizens are looking into crypto as a better store of value than traditional finance. Companies such as Coin Metrics say that if the growth rates continue, Bitcoin will exceed the US Bond market:

“Bitcoin’s current daily volume would need “fewer than 4 years of growth to exceed the daily volume of all US equities and fewer than 5 years to exceed the daily volume of all US bonds.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post