Cryptos saw $1B in liqudations as both BTC and ETH lost major support levels we can see more today in our latest altcoin news today.

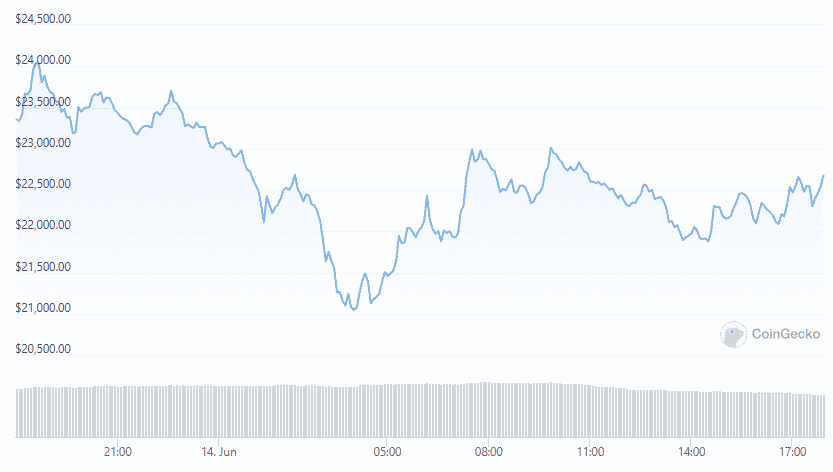

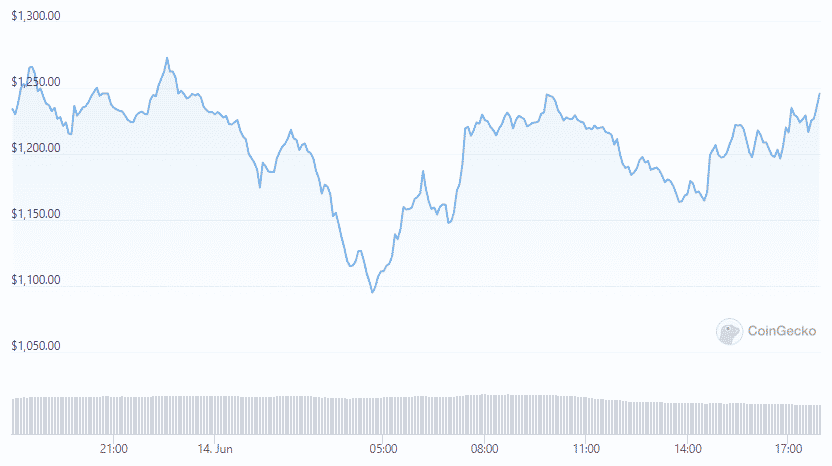

Bitcoin lost the $25,000 level while ETH slid to $1200. The crypto-tracked futures lost over $1 billion in the past day and were weighed down by a weak sentiment for BTC and other coins amid the weak global economic outlook. The liqudations refer to when the exchange forcefully closes a trader’s leveraged position because of a partial or total loss of the trader’s initial margin and it happens when a trader is unable to meet the margin requirements of the leveraged positions.

The losses came as BTC lost major support of $25,000 with the crypto market cap reaching levels seen in January 2021 and most cryptocurrencies dropped by 15%. Bitcoin accounted for 2 million of all the liqudations right after Ether at 7 million and SOL tokens at million.

buy temovate online www.adentalcare.com/wp-content/themes/medicare/editor-buttons/images/en/temovate.html no prescription

The Futures tracking Cardano ADA, GMT, and Binance ecosystem tokens saw over $6 million in losses with 213,000 individual trading accounts seeing liquidation in the past day.

Longs or traders that bet on the higher prices, saw $510 million in liqudations and the shorts or the bets on lower prices saw $554 million in losses which suggests futures traders are adding to the market volatility and affected traders equally in either direction. FTX recorded over $417 million in liqudations which is the most among its counterparts followed by OKX at $251 million and Binance at $198 million. The open interest dropped by 7% in the past day to $23 billion which suggested a huge amount of traders closed the positions expecting further market volatility.

BTC traded at over $22,000 in the EU with a 12-week slide continuing. The asset lost 66% of its value from a high of $69,000 in November. Most of the decline came after the US FED planned to hike the rates in the upcoming months and battle the effects of record inflation which is a move that caused a spike in global stocks and cryptocurrencies with investors taking money off assets seemingly risky. The sentiment among market observers remained bearish with some warning of major losses ahead.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post