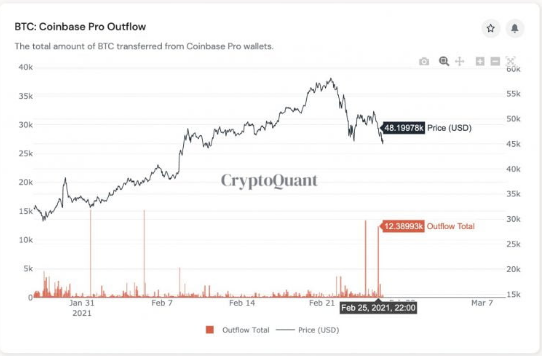

Data analytics firm CryptoQuant detects massive outflow of BTC from crypto exchange Coinbase as the BTC/USD pair experienced a massive sell-off so let’s read more in our latest BTC news.

The South Korean portal reported about 12,380 BTC units worth more than $575 million which left the exchange on Thursday. The assets made way into the custody wallets of the exchange which as the data analytics company noted, represents addresses that have associations with the OTC BTC trading service. Ki-Young Ju who is the chief executive of CryptoQuant, treated the outflow as a new metric to gauge the booming institutional interest in the BTC market and noted that the investors purchased the cryptocurrency when it dropped to $48,000 following a sell-off on Thursday. Later, they transferred the coins to other Coinbase Custody wallets.

When traders withdraw tokens from a trading platform, it only shows intent to hold instead to trade an asset for another one. That also decreases token liquidity on the exchange that usually leads to a price spike if the demand grows higher. CryptoQuant detects spikes in the BTC outflows from Coinbase which led to a higher price for the cryptocurrency. The BTC/USD exchange rate skyrocketed from $28K to $58,367 on the exchange after the exchange reported two huge withdrawals at the end of January 31.

Each outflow coincided with the institutions announcing an entry into the BTC Sector like the withdrawal following Tesla’s revelation that it purchased $1.5 billion worth of BTC. This prompted Mr.Ju to see even bigger activity from institutions as the BTC outflow surged on February 25. Ju recognized the recent sell-off in the BTC market which appeared due to the strong psychological pressure built by rising government bond yields in the US as none of the on-chain indicators showed a bearish sentiment brewing on the market.

buy avanafil generic buy avanafil online no prescription

The yields on the Treasury notes surged in late Thursday and we saw the Labor Department data showing a slowdown in the number of Americans filing for jobless benefits in the previous week. This led to many investors seeing the FED increasing the rates given its taper dovish policies if it seems a substantial recovery on the job market. BTC surged about 1200% from the depths of the COVID-pandemic lows as investors looked for returns after the US central bank stimulus dropped the interest rates to near-zero. Ju noted:

“I think the major reason for this drop is the jittering macro environment like the 10-year Treasury note, not whale deposits, miner selling, and lack of institutional demand.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post