The crypto fund Grayscale says that the Bitcoin market currently looks like 2016 as the yearly BTC bull run has sent ripples across space with some saying that the asset will hit an all-time high later this year so let’s read more in the Bitcoin news today.

The crypto fund Grayscale Investments said in a recent report that bitcoin is showing signs that it did before the 2017 bull run. The market structure “bears parallels that of early 2016 before it began its historic bull run.” The company identified several on-chain metrics that pointed towards the increased public sentiment in the broader crypto market and one important takeaway from it was the increase in the long-term holding over the short-term speculation which indicated a sustainable price rally compared to the 2017 boom.

As I suggested 6 months ago, we are now starting to see businesses owning Bitcoin as a marketable security on their balance sheet. MicroStrategy Adopts Bitcoin as Primary Treasury Reserve Asset. Just. Getting. Started. https://t.co/dVUOr8Loac

— Preston Pysh (@PrestonPysh) August 11, 2020

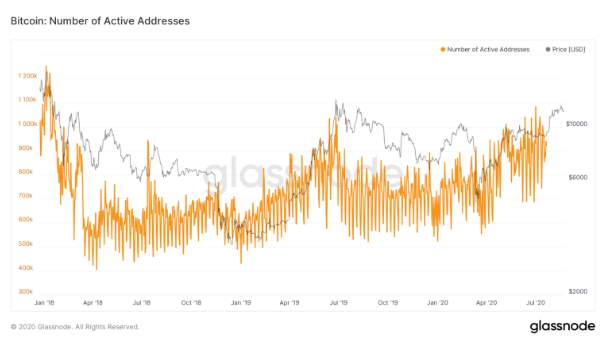

The company predicted that both retail and institutional demand for BTC will grow in the near term as the inflation increases, caused by the governments across the world that are printing money to boost the economy that is affected by the ongoing Coronavirus pandemic. This highlights the need for the “scarce monetary commodity” and Bitcoin fits the narrative according to grayscale. Furthermore, the company noted that the daily active addresses are at the highest level since the 2017 bull run. The data from Glassnode confirms this finding.

Grayscale said that the increasing dependence of the US economy on quantitative easing to the only remain afloat showed that it’s an addition that is hard to quit. Bitcoin is not the only market that surged, however. S&P index, metals and commodities, and other global markets dropped in the mid-march and gained strength over the past few months which is a noticeable V-shaped recovery.

The Grayscale clients viewed the “unprecedented monetary and fiscal stimulus” as a negative and are looking at alternative assets such as BTC to hedge their holdings. Larger corporations share that sentiment as the enterprise software firm MicroStrategy announced that it invested more than $250 million in bitcoin to protect against the worsening economic outlook. The company also considered Bitcoin as a new-age form of money.

In the meantime, Grayscale asserted that bitcoin has attributes against gold and cash and it even quoted Paul Tudor Jones who said:

“Bitcoin had an overall score of nearly 60% of that of financial but has a market cap that is 1/1200th of that. It scored 66% of gold as a store of value, but has a market cap that is 1/60th of gold’s outstanding value.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post