Company giants that aim to invest in Bitcoin could derail the entire stock market and this data comes right after Tesla announced the $1.5 billion investment in BTC and expects to start accepting the crypto as payment for vehicles in the near future. However, what does this actually mean for the stock market? Let’s find out in our latest bitcoin news.

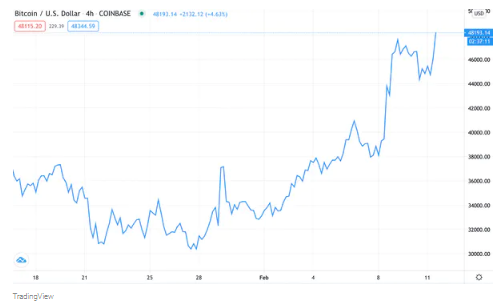

The price is now up by 50% over the past six weeks of the near and led by Tesla’s investment which is certainly in profit already, it is likely to be worth $2 billion in the near future. To put this into context, when the car manufacturer made its first annual profit in 2020 it was just set at $700 million. Tesla’s move into BTC came on the back of a wave of institutional money invested in the leading cryptocurrency plus the many other companies that are putting some more into their treasury reserves. With the sixth most valuable company saying that that it will buy and hold other digital assets in the near-term, it is quite tempting for other company giants to enter the market.

Since the tesla announcement, Twitter CFO Ned Segal signaled that his company considers a move like this one while the note from Royal Bank of Canada made a case for why it will benefit Apple. Tesla justified the change in way management of its treasury reserves by stating that investing In BTC will provide more flexibility to diversify and to maximize returns on the cash so corporate treasurers used the money markets to invest the surplus cash to get out with smaller yields but it is harder to be used in the long-term.

Bitcoin is highly volatile so you would not typically associate it with cash reserves on a company that is worth nearly a trillion US Dollars. The price dropped below $4000 and in 2021 it fell more than 30% before the surge. Tesla put 8% of its reserves into crypto so if Google, Twitter, Facebook, Microsoft, and Apple o the same, it will mark 1% of the total worth of the bitcoin market. This rise could drive up the value of the BTC on the balance sheets of the companies which only shows it was the right time for investment.

The one problem could be the effect on the company’s share prices. Tesla’s share price increased 2% but it then dropped by 5%. However, Microstrategy’s share price increased tenfold over the past year but got down by a quarter in the days since the Tesla announcement.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post