CME’s Bitcoin market dominance is slowly fading away despite the market becoming a prominent part of the Bitcoin ecosystem. The interest seen across platforms is skyrocketing but something doesn’t add up so let’s find out more in our Bitcoin news below.

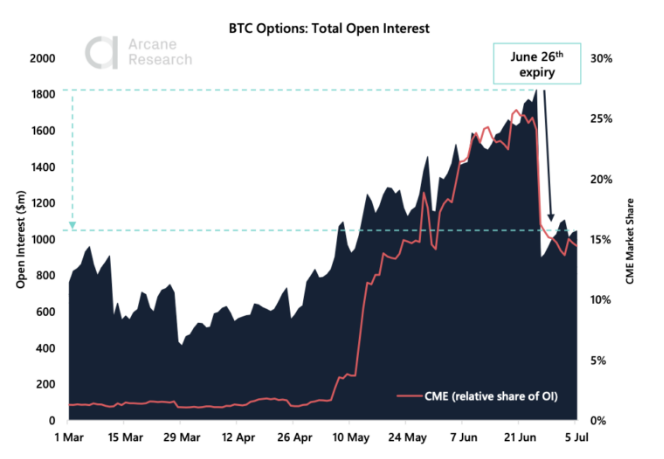

Last month, the number one cryptocurrency saw its biggest options expiry in history with more than $1 billion worth of quarterly contracts expiring in one day. At this time, this represented more than 60% of the total outstanding OI. The expiration caused the OI for options contracts to drop and the data now shows that CME’s Bitcoin market dominance is fading away after getting hit by this decline.

Institutional investors are becoming less interested in trading contracts for Bitcoin because the platform is losing its share over the options market. On June 26th, a combination of monthly Bitcoin options contracts expired and their value reached $1 billion. This marked the biggest single-day expiry that was ever seen in the industry which means it is a sign of the options market’s immense growth over the past year. OI for contracts dropped after this expiry happened to fall from $1.8 billion to $894 million.

The CME, a platform that caters to active funds and institutions because of its high minimum contract requirements was hit hard because of this contract expiry as interest on the platform dropped by 67%. Arcane Research explained:

“The total bitcoin open interest halved (falling from $1.8 billion to $894 million) following the large contract expiry of June 26th. CME was hit the hardest as its open interest dropped 67% from $439 million to $145 million on the day of the contract expiry.”

It doesn’t seem that institutional traders are looking happy to jump back into a new Bitcoin position either as CME’s market dominance of the options market has dropped from 25% to 15%:

“The loss in open interest caused CME’s relative shares of the total open interest to plummet from 25% of the market to below 15%.”

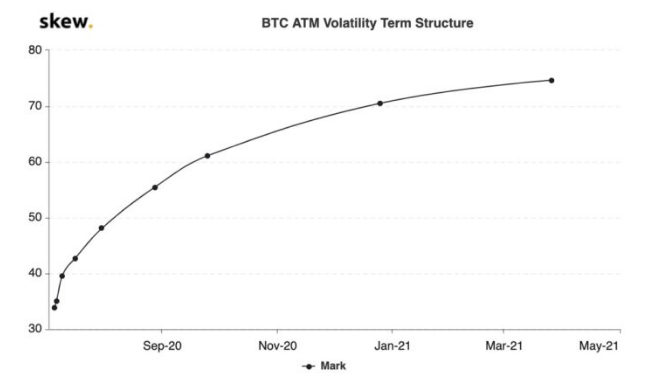

Over the same period, Deribit’s dominance increased by 8%. Bitcoin’s options market seems to be suggesting that the benchmark cryptocurrency will continue to extend the consolidation in the weeks ahead. A research firm noted:

“Bitcoin having one of its very quiet moment, implied volatility term structure is record steep.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post