According to new research and a set of new SME data, institutional investors were kind of undeterred by the recent BTC drop. As we saw this week in the Bitcoin news, the price of BTC corrected sharply after rejecting at $10,400 but the CME BTC futures data shows that the institutions still remain bullish.

Anyways, the CME Bitcoin (BTC) futures and options markets expired on May 29, and despite the $100 hiccup, the price of the largest coin on CoinMarketCap held up nicely around the $9,400 level.

As the market entered the final trading session yesterday, the CME data indicates that open interest for CME Bitcoin futures expiring in May was rather small at $30 million. However, this does not mean that institutional traders abandoned the Bitcoin markets – instead, the open interest for upcoming months remains at $400 million which is a very solid level.

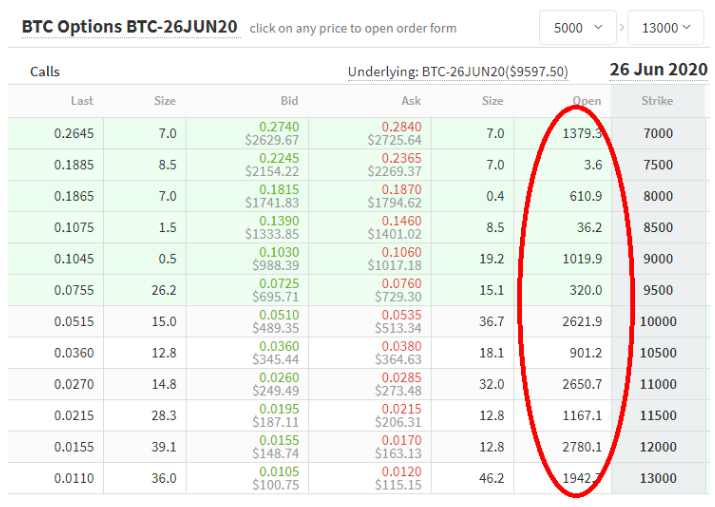

Another good factor in the cryptocurrency news and specifically CME’s Bitcoin options markets, is the fact that $120 million worth of $11,000 and $13,000 call options for the June and July expires were traded. This is obviously a bullish sign and what is often called a “Bull Call Spread” strategy where one would simultaneously buy the $11,000 call option and sell the $13,000 one.

The CME options open interest amounts to $230 million and the bullish trades are very much in line with the previous month’s report, which saw a major (1000%) increase in the CME options market activity.

An issue worth noting is the open interest data provided by CME in a new research – which has a two-day lag. You can see more details on the photo below.

As we can see, there are a healthy 15,500 Bitcoin call options to $13,000 for June, along with 11,500 for other strikes up to July. In total, this amounts to $255 million which should be compared to put the options (bearish) open interest down to $6,500.

The CME data indicates that the institutional investors’ positions are solid and the momentum behind Bitcoin (BTC) is bullish now. As we can see in the news today, the dominant coin went through a minimal BTC drop and is now trading in the $9,500 zones with a lower volume this morning.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post