Chinese miners look for cheaper mining power which led to a drop in the Bitcoin hash rate as the network data shows so let’s look into it some more in the latest bitcoin news.

Most of the Chinese miners look for cheaper power while they are located in the southwest provinces of China and they even turned off their equipment to deal with the rising electricity prices as winter nears. They are moving their equipment to other regions in China where the electricity is cheaper. While Bitcoin’s hash rate increased in 2020, it witnessed a sharp decline recently according to reports. The drop in hash rate happened because the miners paused all operations. They have been relocating to other regions in China where they can access cheaper electricity for mining.

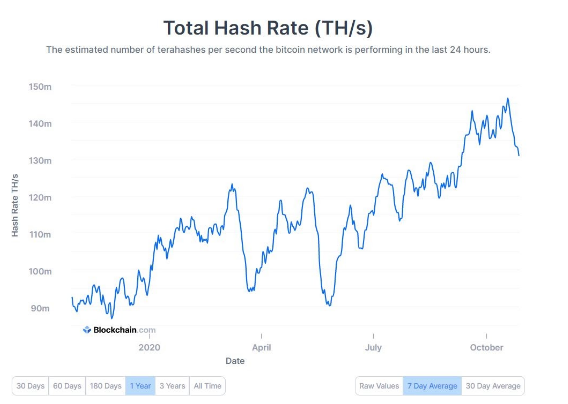

Bitcoin’s seven-day average hash rate dropped by more than 10% in ten days starting from 146 million TH/s On October 18 to 131 million TH/s on October 27. From June to October, the southwestern provinces of China had excess resources of water that were used for hydro energy. This resulted in cheaper electricity and attracted more crypto mining operations. The situation changes over the dry winter month which usually causes the prices to increase. BTC miners now have to move their equipment to other regions in China where the electricity remains cheaper like Xinjiang or Inner Mongolia. The miners will take advantage of cheaper electricity from fossil fuels like coal.

In a Proof of Work blockchain like Bitcoin, the network is secured by miners that run on specialized hardware to mine blocks. The hardware usually in the form of ASICs consumes a lot of energy. The miners, therefore, have to work to keep electricity costs down to maintain profits. China is home to about 65% of the Bitcoin hash rate. Any impact on the Chinese miners is reflected in the network’s hash rate. In the past, the network experienced a drop in the hash rate when the miners were strongly affected by floods.

The declining hash rate is also a subject on how this could impact the price and it turns out that the fallen hash rate could not correlate the short-term. Despite the weekly increase in Bitcoin’s price during the dropping hash rate, Bitcoin saw a pullback as well and the commentators even predicted that the declining hash rate could take the price of Bitcoin even further. One expert said:

“I don’t subscribe to the theories that hash rate affects price. It’s the other way around.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post