A Bull BTC case grows, millions of coins are getting sent to dormant accumulation addresses with the price remaining stagnant over the past few days and the bulls catalyzing above the $40K on the first attempt as we read more in today’s Bitcoin news.

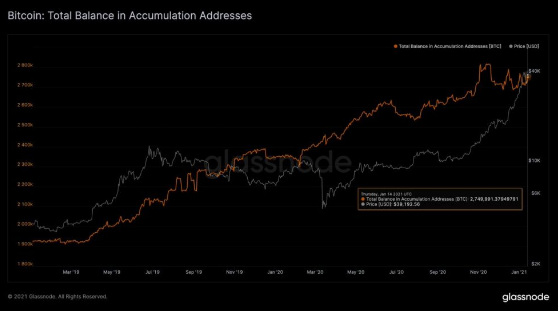

The selling pressure remained significant and whether or not this level is broken above, there’s a chance of setting the tone for its mid-term trend. Looking from a technical perspective, BTC’s short-term outlook remains unclear as it is now moving lower despite being bullish among other altcoins. It could soon reclaim some of the dominance over the market and shoot higher but the $40K resistance remains a major hurdle. An on-chain analyst is now noting that there’s about 3 million BTC held in accumulation addresses up by 17% in the past year which is a bullish fundamental sign for the crypto.

The Bull BTC case grows with Bitcoin struggling to gain any serious momentum over the past few days and weeks with the sellers building massive resistance around the $40,000 with the cryptocurrency posting a strong rebound from the recent lows of $30,000 that were set last week but remains unclear whether or not the v-shaped recovery was seen in the time since is enough to spark a new growth wave.

Another on-chain analyst noted that there’s technical uncertainty still but BTC remains fundamentally bullish and pointed to a continuous increase in BTC accumulation addresses saying that this suggests that there’s an imminent growth on the charts. At the time of writing, BTC is trading down by more than 5% with a current price of $37,120 which marks a notable decline from the highs of $40,000 that was tapped yesterday. The selling pressure remains unable to be surmounted and could continue the downside that could prove to be grave for the entire market.

One bullish trend that is now underpinning BTC’s growth which starting an accumulation pattern among retail investors. This is elucidated by the number of accumulation addresses that the crypto has which now contains 2.7 million dormant BTC, as the on-chain analyst said:

“2.7 million $BTC are held in accumulation addresses – that’s an increase of 17% in the past year. These are addresses that have received at least 2 incoming transactions and have never spend funds. Miner and exchange addresses are excluded.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post