BTC whales buy aggressively since Christmas according to the latest data that we have in our BTC news.

The high net worth investors so-called whales started buying BTC a few days ago but it seems that these bTC whales buy aggressively and are not stopping. The data shows that the high net-worth-investors are buying up more of the supply of BTC so it is impossible to segregate the institutional investors from individual investors via the on-chain data. However, the trend shows that investors with bigger capital are entering into the market despite the rally.

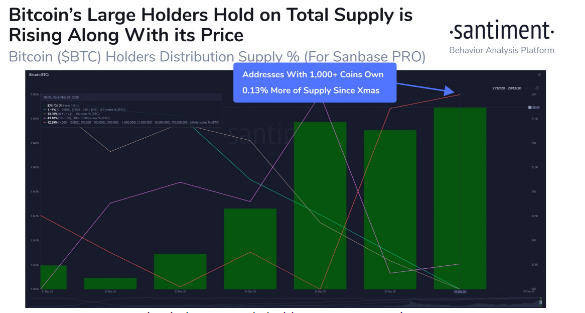

According to the analysts at Santiment, more than $647 million worth of BTC was transferred from small addresses to bigger addresses. The addresses holding about 10000 BTC are considered whales by many analysts since 1000 BTC is equivalent to $27 million:

“Over the last 48 hours since Christmas, #Bitcoin addresses with 1,000 or more $BTC now own 0.13% more of the supply that smaller addresses did previously. This is about 24,158 tokens, which translates to $647.7M at the time of this writing.”

BTC has increased about three times since mid-2020 and the upside for the cryptocurrency is limited in the near future. Still, most on-chain data points that fewer whales are selling across major exchanges as Ki-Young Ju said:

“BTC whales seem exhausted to sell. Fewer whales are depositing to exchanges. I think this bull-run will continue as institutional investors keep buying and Exchange Whale Ratio keeps below 85%.”

There are two main reasons why the whales could be accumulating BTC at the current price range but in spite of the overextended rally, the whales have to believe that this psychological barrier at $30,000 will be broken. If so, the options data suggests $36,000 could be a target in the near-term. Also, there’s no solid reason to anticipate a huge correction coming apart from the CME gap and the high futures market funding rate.

If BTC consolidates after each rally, the funding rate will likely normalize. When this happens, the derivatives market will be less overheated and could even spike a new rally. The trader dubbed “Byzantine General” said that the market is giving conflicting signs:

“Such conflicting signals rn. Both longs & shorts are being overly aggressive lol. I should probably sit on my hands.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post