BTC tradings against the Ruble surge as the national currency of the country is crashing and hitting record lows as we can see further in our latest Bitcoin news.

The Ruble/BTC trading volume surged to a nine-month high as the Russian currency crashed against the dollar in the wake of Russia’s invasion of Ukraine. As per the blockchain analytics company Kaiko, the ruble-denominated BTC traders blew up by about $1.5 billion. The bulk of the activity was concentrated on Binance confirming Kaiko research analyst Clara Medalie in an email to the publication. The data revealed that Tether/Ruble’s trading volume increased to an eight-month high of 1.3 million RUB.

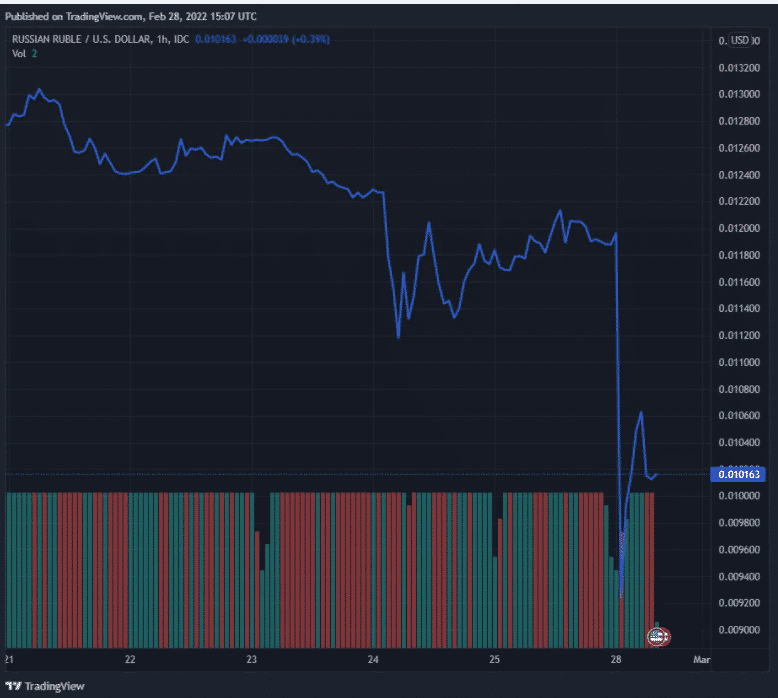

The ruble dropped by 30% against the dollar on Monday morning to less than 1 US cent before staging a limited recovery as the Russian central bank raised the key interest rate. Russia’s invasion of Ukraine prompted rapid sanctions from North America and the EU including Russia’s ejection from the SWIFT payments system and a ban on deals with Russia’s central bank that holds about $630 billion in foreign exchange reserves overseas coffers. The measures are aimed to isolate Russia’s economy and it will be hard for Russia to find a place to workaround.

With the ruble collapsing, the Bank of Russia is prevented from selling the forex reserves to mitigate the damage. Crypto can provide a means for Russians to evade economic restrictions but it could not be the case for a longer period of time. The Biden administration is in the early stages of exploring sanctions on Russia and it will target exchanges that violate bans against the transactions like blacklisitng Russian banks. The Director of the Centre for Financial Crime and Security Studies at RUSI said that in addition to the legal pressure faced by exhcnages:

“There is a reputation issue here. Do you want now or after the fact to be known as the exchange that facilitated sanctions evasion… even if it were not technically legal?”

I'm asking all major crypto exchanges to block addresses of Russian users.

It's crucial to freeze not only the addresses linked to Russian and Belarusian politicians, but also to sabotage ordinary users.

— Mykhailo Fedorov (@FedorovMykhailo) February 27, 2022

Ukraine’s Vice prime minister Mykhailo Fedorov asked all major exchanges to block addresses of Russian users. Both Kraken and Binance declined to enforce this request and Binance cited its commitment to protecting the customers while Kraken CEO Jesse Powell argued that there’s no legal requirement to comply with the request. Binance confirmed that it will block the individual Russian accounts targeted by sanctions all while Ukraine plans to make legal demands of exchanges with Yulia Parakhomenko telling the publication that this is a much-needed measure.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post