BTC slips below $42K with the macro risks mounting and kept the traditional investors from following the LFG’s lead in accumulating BTC at a current value so let’s read more in our latest bitcoin news today.

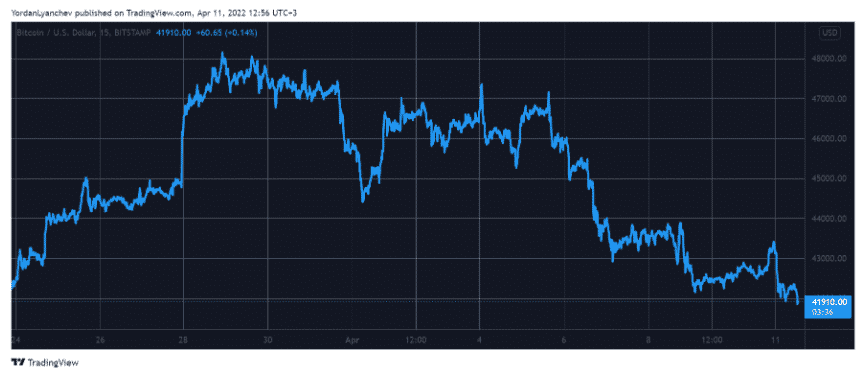

The investors looking for more clues on the BTC’s recent failure to cheer the continued accumulation by the LUNA Foundation Guard want to look at the growing list of macro risks and what seems to be happening in the traditional markets. BTC slips below $42K and during EU hours and hit the lowest level since March 22 and extended the drop from the late March high of $48,240 and the continued slide came as the LFG added $173 million in BTC to the wallet over the weekend that boosted the holdings to almost 40,000 BTC.

The weakness stems from the traditional investors that refuse to follow the LFG’s lead and consider the economic and political uncertainties that stalked the risks assets as per Noelle Acheson who is the head of market insight at Genesis Global. The DXY strength is a part of it but overall it is market uncertainty and the micro concern and a focus on the rates.

The dollar index tracks the greenback’s value against major and tapped a two-year high above 100 early today and took the YTD gain to 4.3% as per the data provided by the charting platform TradingView with the global reserve increasing 1.

buy strattera online https://gaetzpharmacy.com/strattera.html no prescription

5% this month. According to co-founder and global head of strategy at Delphi Digital Kevin Kelly the dollar and BTC have an inverse correlation:

“2017 was one of the worst years for the dollar, and that coincided with a huge run in bitcoin. We saw bitcoin run-up in early 2021. That was on the back of the dollar weakness.”

According to the Reuters poll, the FED will raise the rates by 50 points during June and May meetings after having raised borrowing costs by 25 basis points a month ago and the US 10year Treasury yield increased to a high of 2.7%. the crypto’s sensitivity to equity markets is a cause for concern and the big tech is suffering from the liquditiy available to allocate the high-growth sector is dwindling with the market pricing faster enhancing by the FED:

“We also have increasingly frequent reports of tech company shutdowns, layoffs and/or dwindling term sheets.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post