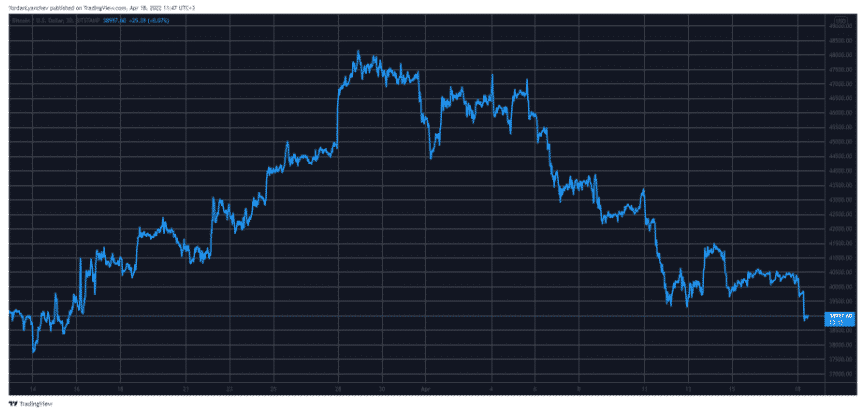

BTC slipped below support levels at $38K with the US tax return deadline nearing and the tax-related selling seems to have aggravated strong weakness in the BTC market so let’s read more today in our latest Bitcoin news today.

BTC slipped below support levels and breached the criticial price support level to hit a one-month low as the US tax season draws to a close. The leading crypto by market value dropped to $38,577 which is a level last seen on March 15. According to data from IntoTheBlock, $40K was a very important strong support as the strong buying activity happened around the same level in the past. The latest drop means that crypto lost over 17% since testing waters near the $48K three weeks ago. The weakness seems to have stemmed from the tax-related selling after a macro environment and for the US investors, the deadline to submit the 2021 tax returns or the extension to file and pay the tax is Monday, April 18, 2022.

The US 10-year Treasury yield increased to 2.88% on Monday which is the highest level since December 2018. The nominal and the real inflation-adjusted US Bond yields were on a tear in the past few weeks thanks to the high inflation and the FED plans to deliver the high rate hikes. The risk assets including tech stocks and crypto also came under pressure.

As per George Liu who is the head of derivatives at Babel Finance, Bitcoin’s enhancing correlation to stocks can be even more dominant as a reason behind the dip below $40K. Liu said:

“The tax issue has been known and anticipated in the markets already, so we don’t see that as a decisive factor for the current price dip. Basically, the short-term correlation between bitcoin and U.S. stocks has reached a new peak.”

Crypto services provider Amber Group shared a similar opinion saying that a lot has to do with the poor macro conditions especially if you look at equities and NASDAQ and the rise in yields. The blockchain data shows that the selling pressure is coming from short-term traders with some major holdings. Chang Chung who is the head of marketing from Korea’s CryptoQuant said:

“Checking on the overall bitcoin network movement from spent output age band USD and spent output value band USD, it seems like the cohort most active during the price change seen a few hours ago was mostly 0~1 week aged coins + UTXO volume in 1M+ USD.”

As Chung noted, up to a week aged coins were in action on Monday which means the selling pressure stemmed from short-term traders. The spent output value band also shows the distribution of the spent outputs according to the value which shows most of the coins that moved into the exchanges today were from 10-100 BTC and 100 BTC as well as 1000 BTC cohorts.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post