A BTC sell-off intensifies among the long-term holders according to new Glassnode research that we have in our latest Bitcoin news.

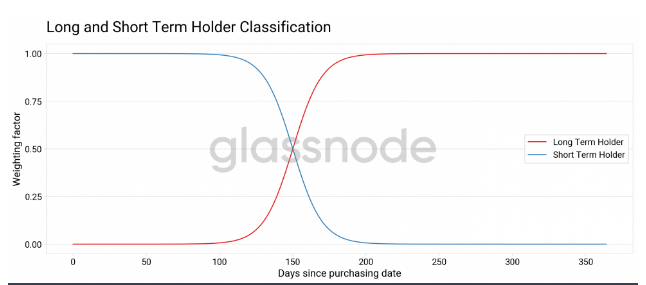

The on-chain intelligence platform studied BTC entities and the supply that they hold in their wallets. It later divided the outcome into two categories: short-term holders and long-term holders.

buy vidalista online https://www.arborvita.com/wp-content/themes/twentytwentytwo/inc/patterns/new/vidalista.html no prescription

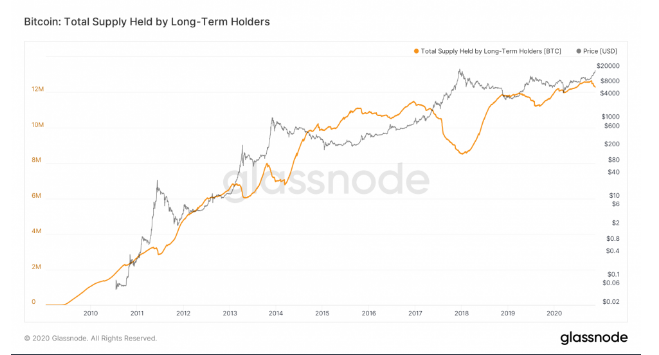

According to the research, the long-term holders or LTC are the wallets that hold BTC for more than 155 days in a row while the short-term holders are the wallets that transfer their coins to other addresses in the first 145 days after purchasing them. The research analyzed both LTN and STH against one another and found that the former’s supply dropped to 12.3 billion BTC over the past few days while on the other hand, the STH supply surged higher with BTC sell-off intensifying in order to secure more gains.

A sell-off b the long-term investors didn’t put any negative pressure on the benchmark cryptocurrency and proved to be bullish for the crypto asset. Glassnode reported that the LTH supply on Bitcoin’s price graph shows a correlation with changes between them inversely. With all that being said, the LTH supply increase means that Bitcoin’s price will fall. When it decreases, the cryptocurrency will start a bull run. Glassnode continued:

“Currently, we are seeing a downward spike, pointing to the fact that BTC from hodlers started to move on-chain, as a reaction to the recent price appreciation. Note that this has been commonly observed in previous cycles as well, and indicates that we are potentially at the early stages of a bull run.”

In the meantime, the BTC price increase when the STH supply goes higher which is a clear indication of older crypto sashes getting reactivated in a bull market for trading according to Glassnode:

“Currently, 12 million BTC of the LTH supply (~97%) and 3.5 million of the STH supply (~97%) are in a state of profit.”

The Glassnode report arrived when the BTC price hit a three-year high of $18,000 representing about 147 percent on a year-to-date timeframe which is led by a depreciation in the US dollar amind the Federal Reserve’s low-interest rate and the bond-buying policies. Analysts await that the BTC/USD exchange rate will grow back towards the record high of $20,000 because Bitcoin is divisible and easily transferable. This technical makes the asset superior to gold. Vijay Boypaty, a popular crypto researcher said:

“Where gold is an ancient store-of-value, Bitcoin is a *nascent* store-of-value with superior monetary properties to gold. If one were to believe it eclipses gold’s market capitalization, due to these superior properties, Bitcoin becomes a very attractive asymmetric bet.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post