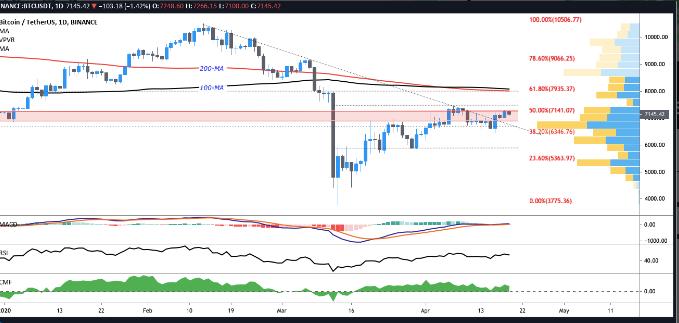

The BTC price fights to close the week above the $7,200 resistance level as it surged within the few dollars reach of the same level and nearing the $7,100 support. This means that the traders will have a close eye on the weekly close of the number one cryptocurrency on the market as we are reading in the bitcoin price news.

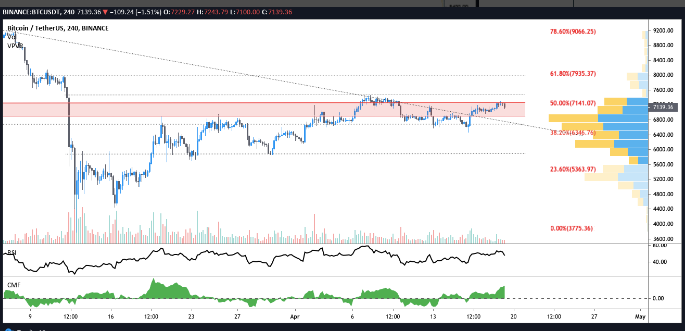

Yesterday (Saturday, April 18, 2020) Bitcoin’s price pushed through the $7,200 resistance and rallied all the way to $7,294 while escaping the resistance cluster and the price was trapped within since April 6.

As the BTC price fights to close the week, the price also surged yesterday alongside other coins that added notable gains. Ether (ETH) reached $189 before pulling back to $182. Chainlink (LINK) reached $3.82 and at the time of writing is trading at $3.70 while Tezos (XTZ) increased by 12 percent to $2.37. The overall cryptocurrency market cap is standing at $208 billion while bitcoin’s dominance rate is 64 percent.

The bullish traders are focused on pushing the price above $7,258 while aiming for $8,000. The next important level for bitcoin will be $7,400 and as it can be seen by the volume profile visible range, there is a small gap to $8,550 but as per the analysis, the 100 and 200-day moving averages have been predicted as the levels of resistance.

The traders expressed their wishes to open short positions from $8,000 and $8,500 but we can only wait and see what will happen next since bitcoin has a tendency to chart its own path against the predictions of many traders. Some of the traders such as Michael Van de Poppe suggested that the exciting price action for the weekend is nothing but a bull trap. Poppe pointed out that the price is battling to overcome the zone that is surrounding the yearly open. He also commented that there is a possibility of the price rallying to $8,000:

“Traders should also take into account that movements during the weekends are usually a lower volume and often “traps.” These are movements in one direction to take liquidity (which is lower during the weekend), which immediately reverse the other way around.”

The price did well in closing above $7,200 and the weekly close approaches multiple rejections at $7,254 which could eventually lead the price back below $7,000. If a reversal is to happen, Bitcoin has small support at $7,121 and below this level at $6,850 and $6,660 is where the price could find its soft spot. Looking in the long-term, the $6,750 area is important as a close below this trendline suggests that bears are on the verge of pulling off the trend.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post